What is a California Loan Agreement form?

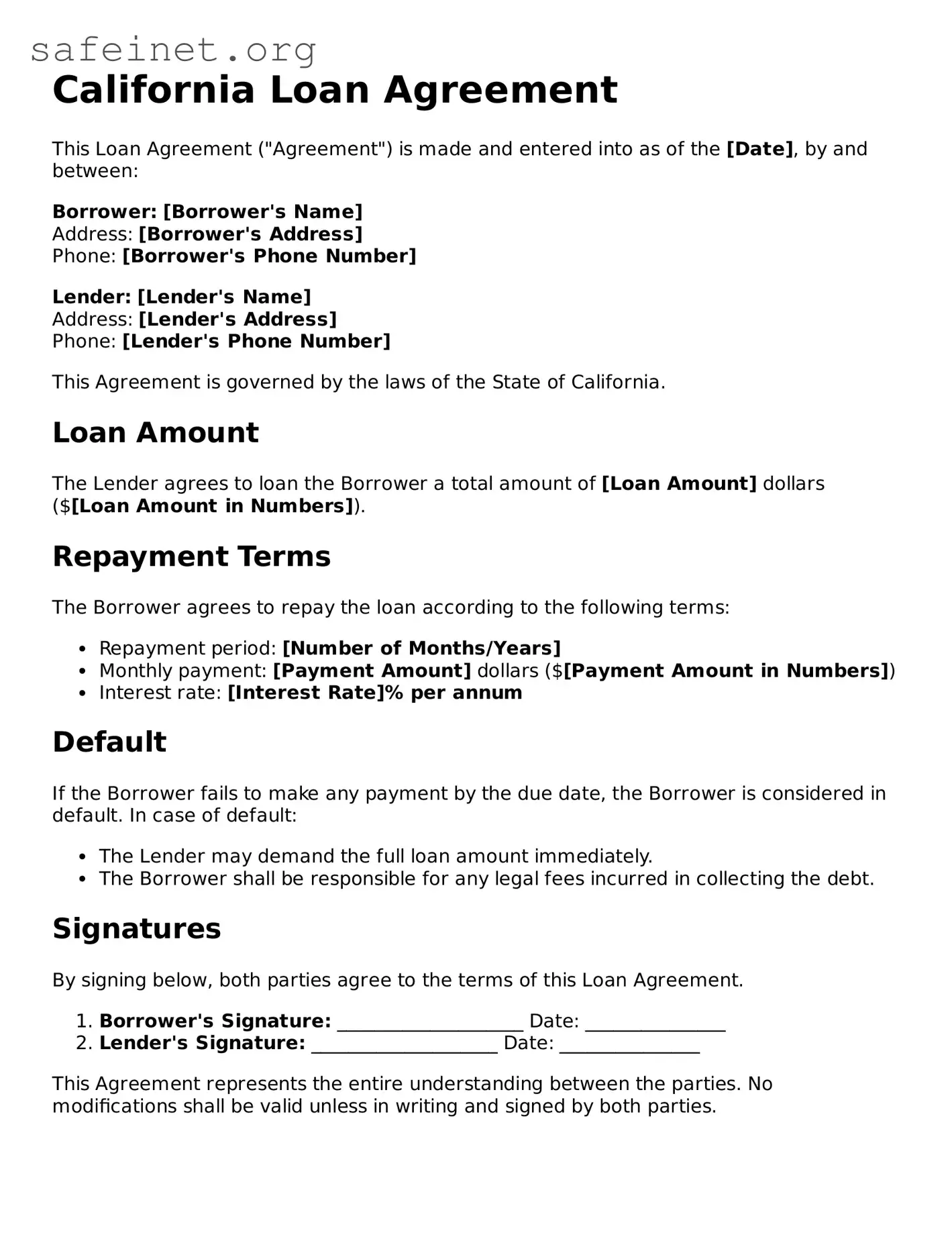

A California Loan Agreement form is a written document that outlines the terms and conditions under which a borrower agrees to receive funds from a lender. This agreement specifies the amount borrowed, interest rates, repayment schedule, and any additional terms required by the lender or agreed upon by both parties. It serves to protect the interests of both the borrower and the lender by ensuring clear communication regarding the loan's terms.

Who can use the California Loan Agreement form?

Both individuals and businesses can use the California Loan Agreement form. Whether it is a personal loan between friends or a business loan for operational needs, this form provides a structured approach for documenting the loan. It is essential that both parties understand the terms and agree to them before signing the agreement.

What key elements are included in the form?

The form typically includes important details such as the loan amount, interest rate, repayment schedule, due dates, and any fees associated with the loan. Additionally, it may specify the purpose of the loan, collateral if applicable, default conditions, and remedies available to the lender in case of non-payment. These components ensure clarity and accountability for both sides.

Is notarization required for the California Loan Agreement?

While notarization is not always required for a California Loan Agreement, having the agreement notarized can add an extra layer of security and credibility. Notarization serves as proof of identity and can help prevent disputes about whether the agreement was genuinely signed by both parties. When significant amounts are involved, opting for notarization is often a good practice.

What happens if the borrower defaults on the loan?

If the borrower defaults, meaning they fail to meet the repayment terms, the lender may have specific rights as outlined in the loan agreement. This could include imposing late fees, accelerating the balance due, or initiating legal action to recover the owed amount. It’s crucial for borrowers to understand the potential implications of defaulting and to communicate with the lender if financial difficulties arise.

Can the terms of the loan agreement be modified after it is signed?

Yes, but modifications typically require the consent of both parties. It is advisable to document any changes in writing and have both parties sign the updated agreement. Oral modifications may not be recognized in court, so it’s best to keep everything clear and documented in order to avoid confusion down the line.

Are there any specific laws governing loan agreements in California?

Yes, California has specific laws and regulations that govern loan agreements. These laws are designed to protect consumers and ensure fair lending practices. For example, there are requirements related to disclosures that lenders must provide to borrowers, as well as limitations on interest rates for certain types of loans. Understanding these laws is crucial for both lenders and borrowers to ensure compliance and avoid potential legal issues.

Where can I obtain a California Loan Agreement form?

California Loan Agreement forms can be obtained online through legal document websites, from attorneys, or directly from local courthouses. Many places offer templates that can be customized to fit specific needs. It’s essential to ensure that any form used complies with California law and accurately reflects the agreement between both parties.