What is a California Last Will and Testament?

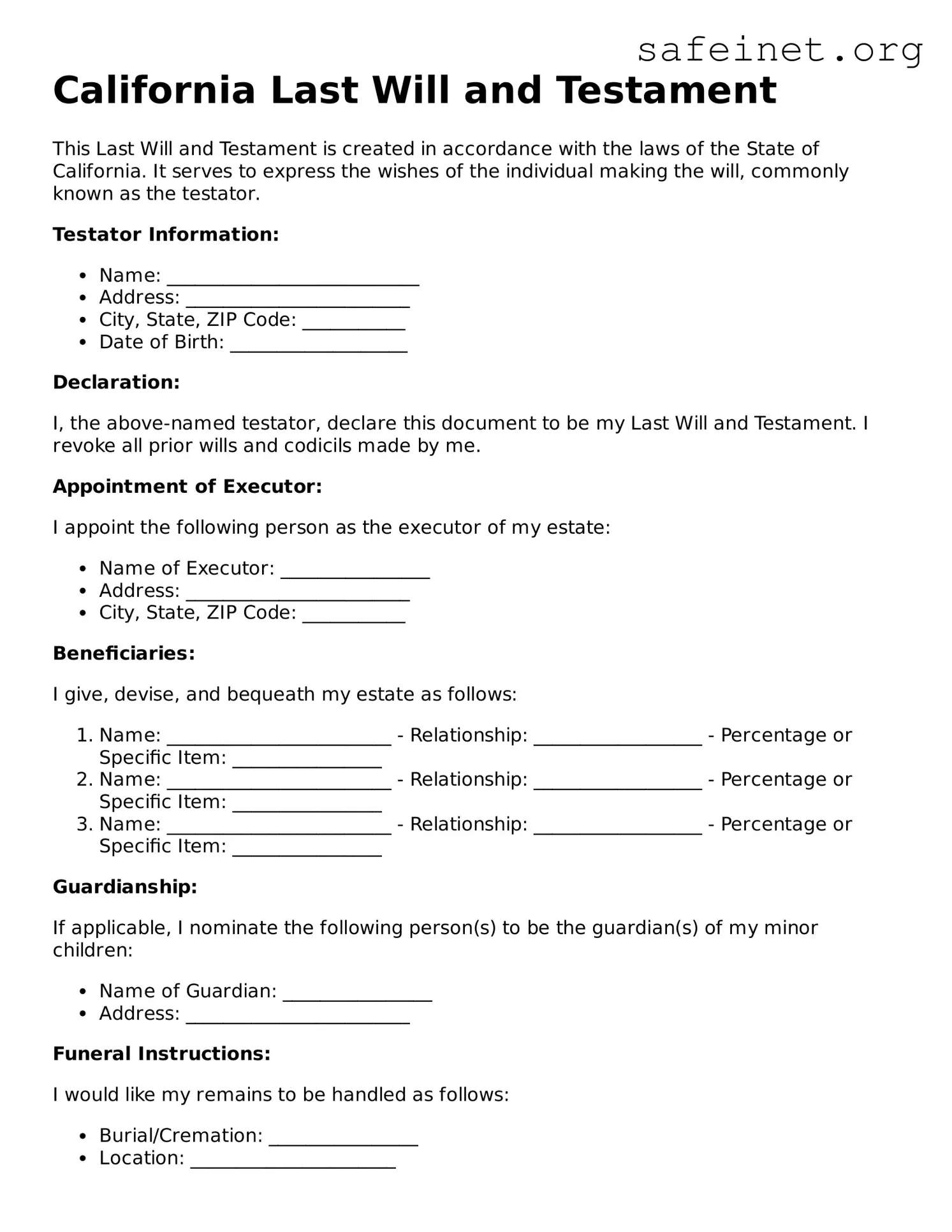

A California Last Will and Testament is a legal document that outlines how a person's assets and property should be distributed after their death. This document allows an individual to specify who will inherit their belongings, name guardians for minor children, and appoint an executor to manage the estate. Having a will in place helps to ensure that your wishes are respected and can simplify the probate process for your loved ones.

Do I need to have a lawyer to create a will in California?

No, you do not necessarily need a lawyer to create a will in California. However, it's important to ensure that your will meets state requirements. You can create a simple will on your own or use templates, but consulting with a legal professional can provide peace of mind. They can help you navigate any complexities, especially if you have considerable assets or specific wishes regarding guardianship or estate distribution.

What are the requirements for a legally valid will in California?

To be valid in California, a will must be in writing and signed by the testator (the person creating the will). Additionally, two witnesses must observe the signing and also sign the document themselves, confirming that they witnessed the testator's signature. It's important to note that witnesses cannot be beneficiaries under the will to avoid any potential conflicts of interest.

Can I change or revoke my will after it's created?

Yes, you can change or revoke your will at any time, as long as you are of sound mind. To modify a will, you can create an amendment, called a codicil, or draft an entirely new will. If you decide to revoke a will, it’s advisable to physically destroy it and notify any relevant parties, such as your executor or family members, about the change.

What happens if I die without a will in California?

If you die without a will, known as dying "intestate," California law dictates how your estate will be distributed. Your assets will follow a hierarchy set by the state, which may not align with your personal wishes. Typically, your spouse, children, and other relatives will inherit your property according to specific rules. This process can be lengthy and may lead to disputes among family members, making having a will beneficial for clarity and control.

How do I ensure my will is safe and accessible after my death?

To ensure your will is safe and accessible, keep it in a secure location, such as a safe deposit box or with a trusted family member or attorney. Make copies of the will and inform your executor and key family members of its location. Additionally, consider registering your will with a local estate registry service, if available. This step can help ensure that your will is found when needed, preventing delays in the execution of your wishes.