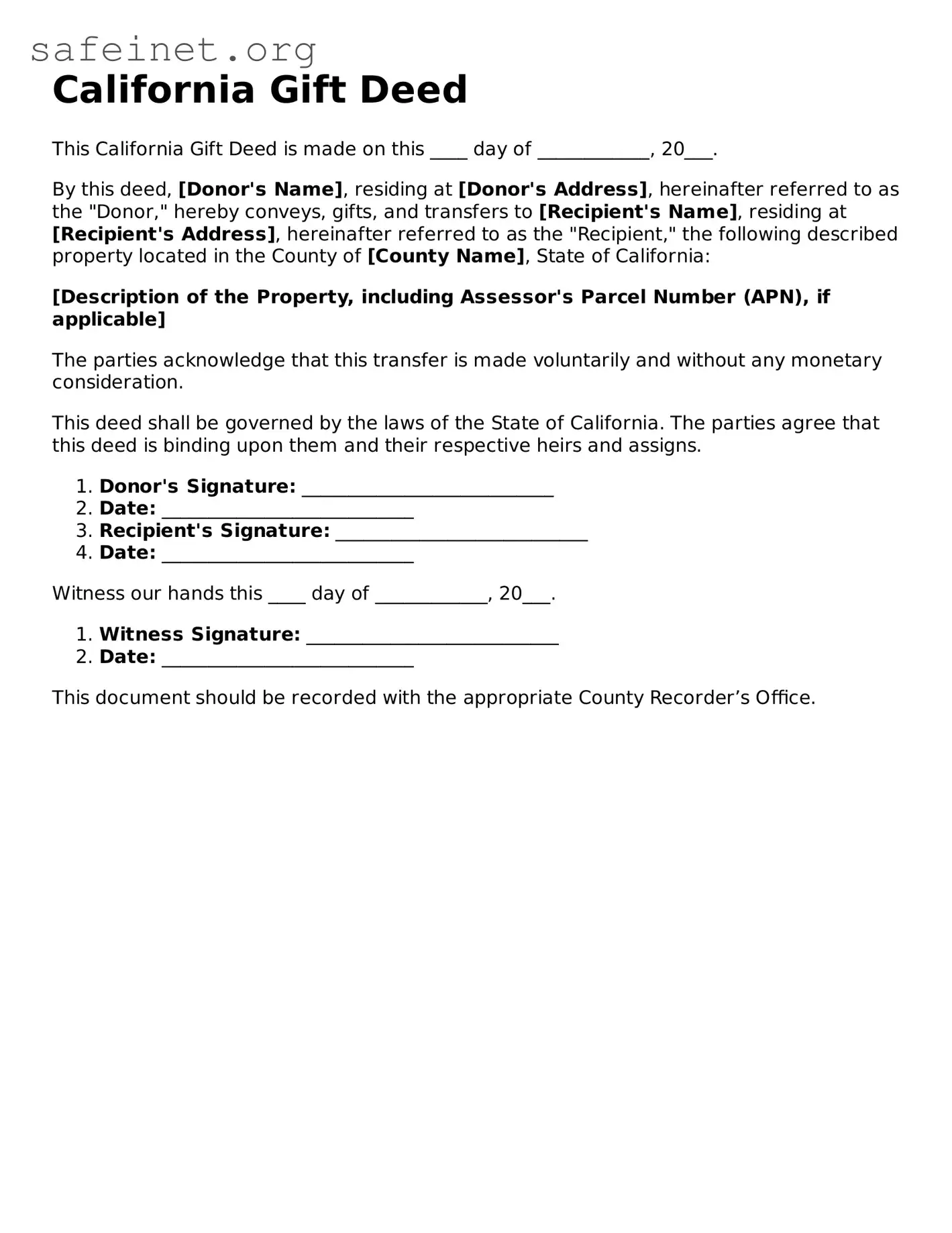

California Gift Deed

This California Gift Deed is made on this ____ day of ____________, 20___.

By this deed, [Donor's Name], residing at [Donor's Address], hereinafter referred to as the "Donor," hereby conveys, gifts, and transfers to [Recipient's Name], residing at [Recipient's Address], hereinafter referred to as the "Recipient," the following described property located in the County of [County Name], State of California:

[Description of the Property, including Assessor's Parcel Number (APN), if applicable]

The parties acknowledge that this transfer is made voluntarily and without any monetary consideration.

This deed shall be governed by the laws of the State of California. The parties agree that this deed is binding upon them and their respective heirs and assigns.

- Donor's Signature: ___________________________

- Date: ___________________________

- Recipient's Signature: ___________________________

- Date: ___________________________

Witness our hands this ____ day of ____________, 20___.

- Witness Signature: ___________________________

- Date: ___________________________

This document should be recorded with the appropriate County Recorder’s Office.