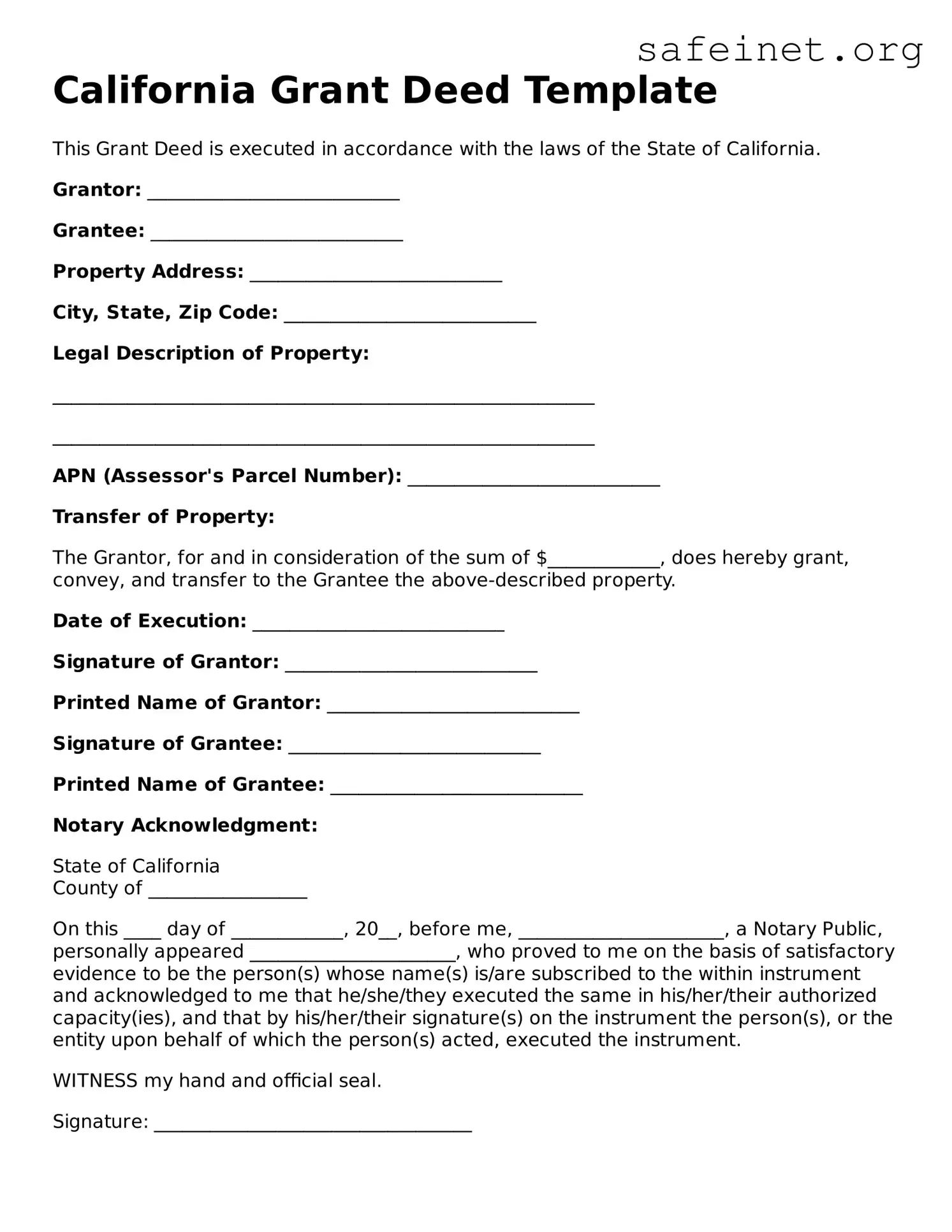

California Grant Deed Template

This Grant Deed is executed in accordance with the laws of the State of California.

Grantor: ___________________________

Grantee: ___________________________

Property Address: ___________________________

City, State, Zip Code: ___________________________

Legal Description of Property:

__________________________________________________________

__________________________________________________________

APN (Assessor's Parcel Number): ___________________________

Transfer of Property:

The Grantor, for and in consideration of the sum of $____________, does hereby grant, convey, and transfer to the Grantee the above-described property.

Date of Execution: ___________________________

Signature of Grantor: ___________________________

Printed Name of Grantor: ___________________________

Signature of Grantee: ___________________________

Printed Name of Grantee: ___________________________

Notary Acknowledgment:

State of California

County of _________________

On this ____ day of ____________, 20__, before me, ______________________, a Notary Public, personally appeared ______________________, who proved to me on the basis of satisfactory evidence to be the person(s) whose name(s) is/are subscribed to the within instrument and acknowledged to me that he/she/they executed the same in his/her/their authorized capacity(ies), and that by his/her/their signature(s) on the instrument the person(s), or the entity upon behalf of which the person(s) acted, executed the instrument.

WITNESS my hand and official seal.

Signature: __________________________________