What are the Articles of Incorporation in California?

The Articles of Incorporation are a vital document needed to create a corporation in California. This document officially registers your corporation with the state and outlines the basic structure and purpose of the business. By filing this paperwork, you gain legal recognition for your company, allowing it to operate independently of its owners.

Who needs to file Articles of Incorporation?

Any individual or group intending to form a profit or non-profit corporation in California must file Articles of Incorporation. This step is essential for anyone looking to establish a business entity that will provide limited liability protection to its shareholders and meet state requirements for doing business.

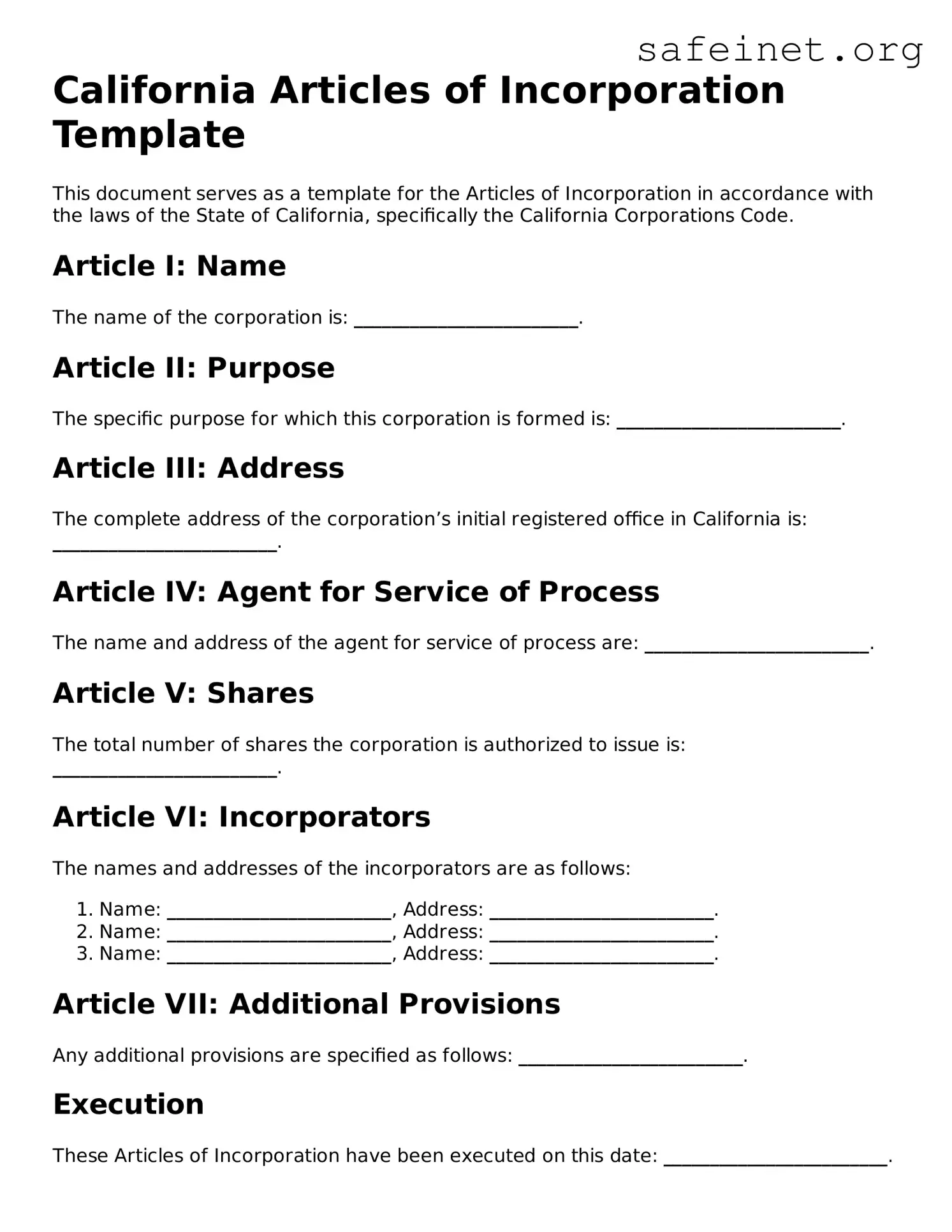

What information is required in the Articles of Incorporation?

The Articles of Incorporation typically require several key pieces of information. You’ll need to provide the name of the corporation, its purpose, the address of its initial business location, the number of shares the corporation is authorized to issue, and the names and addresses of the initial directors. If applicable, details about the registered agent must also be included.

How do I file the Articles of Incorporation?

To file the Articles of Incorporation, you can either submit the form online through the California Secretary of State's website or send a paper form via mail. Be sure to include any required filing fees, which may vary based on the type of corporation you are forming. Filing online can often expedite the process.

What is the fee to file the Articles of Incorporation in California?

The filing fee for the Articles of Incorporation in California generally starts around $100, but additional fees may apply depending on your specific requirements. It’s important to check the most current fee schedule on the California Secretary of State's website before submission, as fees can change.

How long does it take for my Articles of Incorporation to be processed?

Processing times can vary. Typically, if you file online, you might expect a quicker turnaround—often within a few business days. For mailed applications, it can take several weeks. If you're in a hurry, consider paying for expedited service, which is available for an additional fee.

Can I change the Articles of Incorporation once they are filed?

Yes, modifications to the Articles of Incorporation are possible. If you need to change any information, such as the business address or the number of shares authorized, you will need to file an amendment. This entails completing the appropriate forms and submitting them to the state, along with any required fees.

Do I need a lawyer to file my Articles of Incorporation?

While hiring a lawyer can be beneficial, especially for complex situations, it’s not strictly necessary for filing Articles of Incorporation in California. Many people successfully file the form themselves, using available resources and guidelines. However, legal assistance can help ensure your documents are correct and compliant with all state regulations.

What happens after my Articles of Incorporation are approved?

Once your Articles of Incorporation have been approved by the state, you will receive a stamped copy back, confirming that your corporation is officially established. You can then proceed to apply for an Employer Identification Number (EIN), open a business bank account, and take care of any other immediate business requirements.