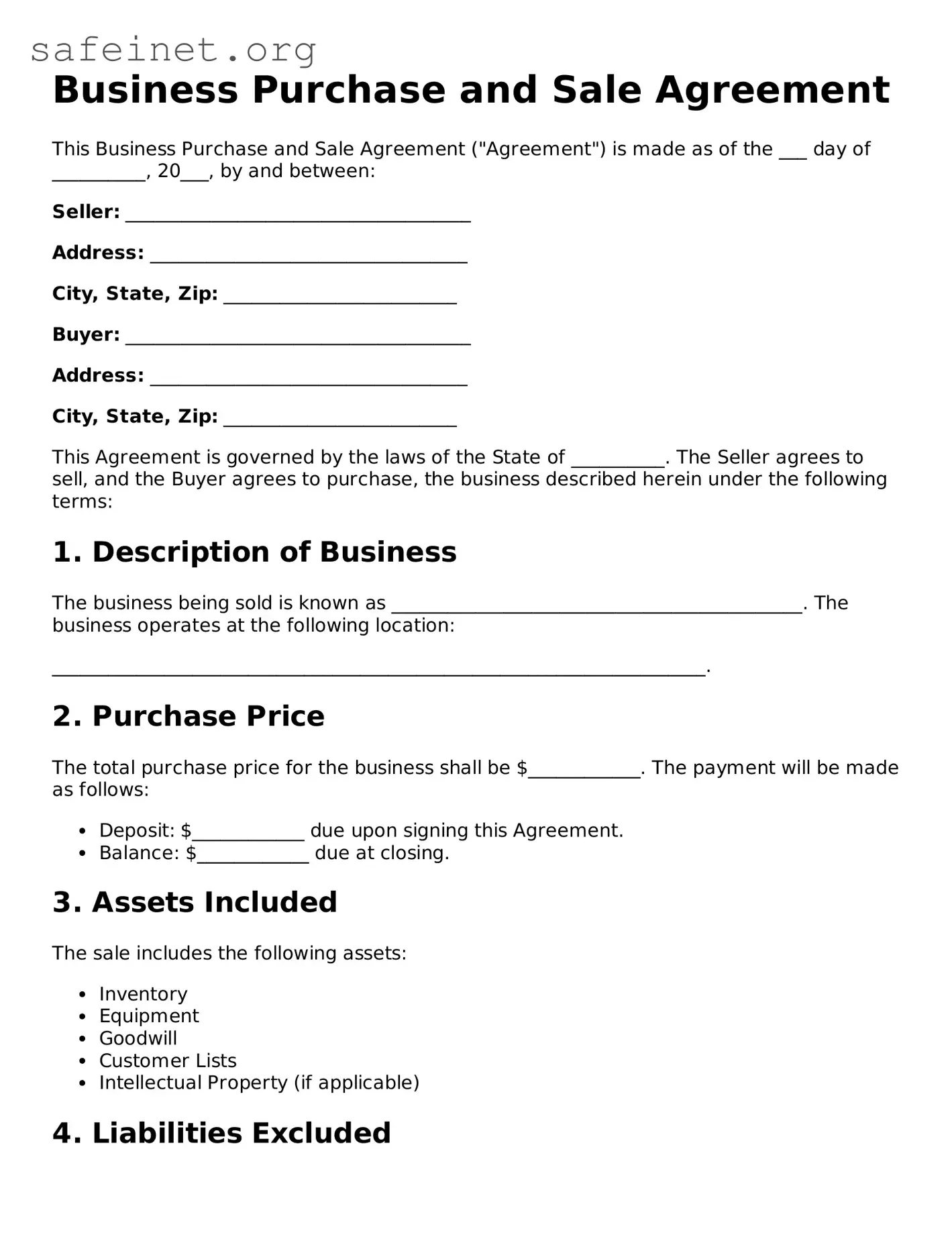

Business Purchase and Sale Agreement

This Business Purchase and Sale Agreement ("Agreement") is made as of the ___ day of __________, 20___, by and between:

Seller: _____________________________________

Address: __________________________________

City, State, Zip: _________________________

Buyer: _____________________________________

Address: __________________________________

City, State, Zip: _________________________

This Agreement is governed by the laws of the State of __________. The Seller agrees to sell, and the Buyer agrees to purchase, the business described herein under the following terms:

1. Description of Business

The business being sold is known as ____________________________________________. The business operates at the following location:

______________________________________________________________________.

2. Purchase Price

The total purchase price for the business shall be $____________. The payment will be made as follows:

- Deposit: $____________ due upon signing this Agreement.

- Balance: $____________ due at closing.

3. Assets Included

The sale includes the following assets:

- Inventory

- Equipment

- Goodwill

- Customer Lists

- Intellectual Property (if applicable)

4. Liabilities Excluded

The Buyer shall not assume any liabilities of the Seller, including but not limited to:

- Outstanding debts

- Pending lawsuits

- Tax liabilities

5. Closing Date

The closing of the sale shall take place on or before the ___ day of __________, 20___, at a location mutually agreed upon by both parties.

6. Representations and Warranties

The Seller represents that:

- They have the authority to sell the business.

- The business is in compliance with all applicable laws.

- There are no pending disputes or claims against the business.

7. Governing Law

This Agreement will be governed by and construed in accordance with the laws of the State of __________.

8. Signatures

IN WITNESS WHEREOF, the parties hereto have executed this Business Purchase and Sale Agreement as of the date first above written.

Seller Signature: _______________________________

Date: _____________________________________

Buyer Signature: _______________________________

Date: _____________________________________