What is a Business Bill of Sale?

A Business Bill of Sale is a legal document that records the transfer of ownership of a business or its assets from one party to another. It serves as proof of the transaction and includes important details like the sale price, asset description, and the parties involved. This document ensures clarity and protects both the buyer and seller during the transfer process.

Why do I need a Business Bill of Sale?

This form is essential for a few reasons. First, it provides legal proof of the transfer of business ownership or assets, which can be crucial for tax purposes and other legal matters. Second, it outlines the terms of the sale, reducing the risk of misunderstandings. Lastly, it can help in case of any disputes that may arise after the sale is completed.

What should be included in a Business Bill of Sale?

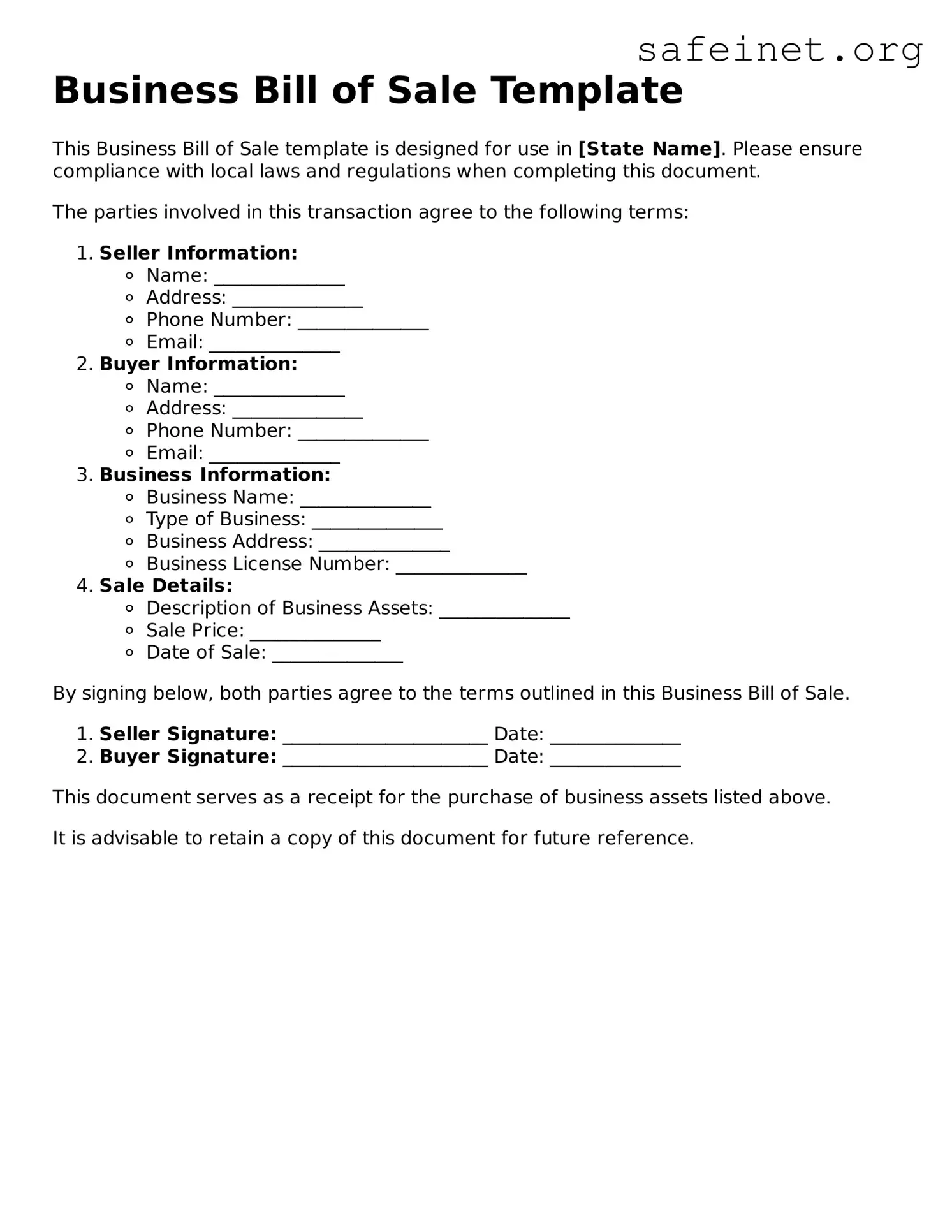

A Business Bill of Sale should contain the names and addresses of both the buyer and the seller, a detailed list of the assets being sold, the sale price, and the date of the transaction. It’s also advisable to include any warranties or representations regarding the condition of the assets, as well as terms for payment, if applicable.

Do I need to notarize a Business Bill of Sale?

While it is not always required to notarize a Business Bill of Sale, doing so can add an extra layer of security. Notarization helps to verify the identities of the parties involved and ensures that they willingly signed the document. Depending on your state or the type of asset sold, it may be beneficial or required to have it notarized.

Can a Business Bill of Sale be used for all types of businesses?

Yes, a Business Bill of Sale can be used for various types of businesses. It is commonly used for sole proprietorships, partnerships, and limited liability companies (LLCs). However, if a corporation is being sold, additional documentation may be needed, such as stock transfer agreements or bylaws, depending on the nature of the sale.

What are the tax implications of a Business Bill of Sale?

The sale of a business or its assets may have tax implications for both the seller and the buyer. The seller could incur capital gains taxes if the sale price exceeds the original purchase price of the assets. The buyer might also have to consider the tax basis of the assets acquired. It is wise to consult a tax professional to understand the specific impacts based on individual circumstances.

How do I fill out a Business Bill of Sale?

To fill out a Business Bill of Sale, start by entering the correct names and addresses of both parties. Next, provide a comprehensive list of the assets being sold, making sure to describe each item clearly. Include the total sale price and any payment terms. Finally, both parties should sign and date the document. Keeping multiple copies for all involved is advisable.

What should I do after completing the Business Bill of Sale?

After completing the form, each party should keep a signed copy for their records. It’s also a good idea to inform any relevant agencies or entities about the change in ownership, if required, such as local business registries or tax authorities. Ensuring that all financial and legal matters are settled promptly will help in making the transition smooth.