What is a Broker Price Opinion (BPO)?

A Broker Price Opinion, or BPO, is an estimate of a property's value provided by a licensed real estate broker. It takes into consideration various factors such as market conditions, comparable sales, and the physical condition of the property. BPOs are often used by lenders and real estate companies to assess property values for lending, sales, or investment decisions.

When is a BPO necessary?

BPOs are typically required in several situations, including the sale of foreclosed properties, refinancing loans, or determining a property’s market value in preparation for a sale. They offer a cost-effective alternative to a full appraisal and can expedite decision-making during the property evaluation process.

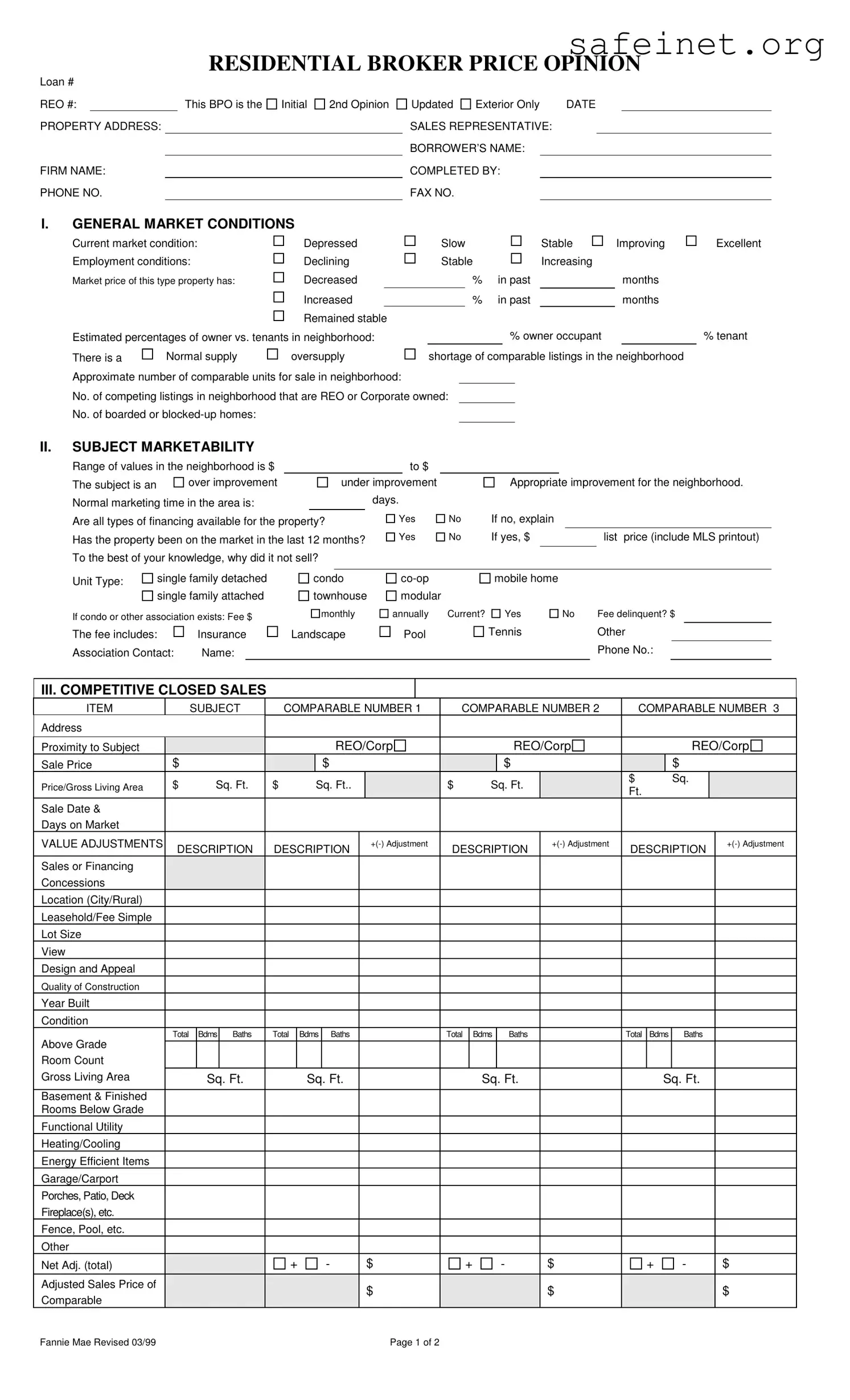

What information is included in a BPO?

A BPO includes details such as general market conditions, the property’s physical characteristics, comparisons with similar properties, and a marketing strategy. It also provides information about needed repairs and approximate costs, as well as a suggested list price for the property in both its current and repaired conditions.

How does a BPO differ from an appraisal?

While both a BPO and an appraisal aim to determine property value, they differ in approach and depth. An appraisal is conducted by a licensed appraiser, includes a more formal and in-depth analysis, and adheres to specific legal standards. In contrast, a BPO is less formal and can be completed by a real estate broker, offering a quicker and often less expensive estimate.

How is the market value determined in a BPO?

The market value in a BPO is assessed by comparing the subject property to similar properties that have recently sold, known as comparables. Factors considered include sale prices, physical characteristics, market conditions, and necessary repairs. This comparative analysis helps establish a reasonable market range for the property.

Can a BPO impact the sale of a property?

Yes, a BPO can significantly impact the sale of a property. An accurate and favorable BPO can lead to a faster sale and a higher selling price. Conversely, if a BPO indicates a lower value, it may necessitate price adjustments or additional marketing efforts. Understanding the findings of a BPO can guide sellers and agents in setting competitive prices.

What should sellers expect from a BPO?

Sellers should expect an overview of their property's current market value, insights into the competitive landscape, and recommendations for repairs or improvements. The BPO will also outline potential challenges, giving sellers a comprehensive understanding of what to anticipate during the selling process.

How long does it take to complete a BPO?

The time required to complete a BPO varies and can range from a few days to a couple of weeks. Factors influencing this timeline include property complexity, market conditions, and the broker’s schedule. Prompt communication between all parties can help expedite the process.

Unknown

Unknown

Investor

Investor