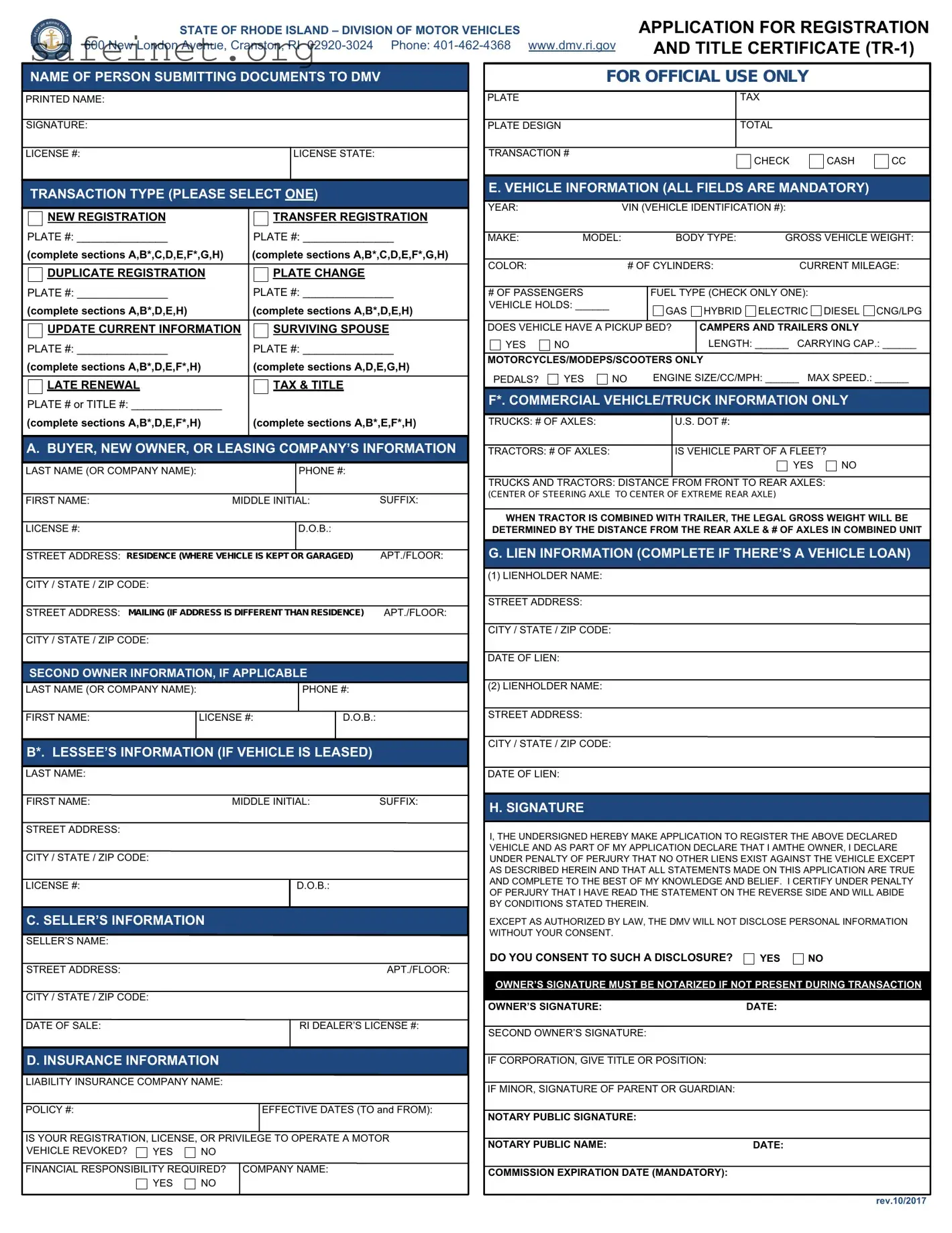

IMPORTANT INFORMATION

1.6.0 - DECLARATION OF KNOWLEDGE:

Commercial motor vehicles with a gross vehicle weight of 10,000 pounds or more or transporting hazardous material.

“I hereby certify knowledge of applicable Federal and State motor carrier safety regulations and laws and declare that all operations will be conducted in compliance with requirements.”

2.Application must be signed by owner personally. Any vehicle registered to any other name than that of the owner constitutes an illegal registration and the registrant thereof is subject to the penalty provided by law.

3.The law prohibits the registration of a vehicle in the name of a person under sixteen (16) years of age. The law requires a person over sixteen (16) years of age to establish evidence of financial responsibility with the Division of Motor Vehicles and to file with the Division a certificate of consent approved by parents or legal guardian before registration can be issued unless special approval is obtained from the Division. Registration card shall, at all times, be carried in the vehicle to which it refers or shall be carried by the person driving or in control of such vehicle.

▬▬▬▬▬▬▬▬▬▬▬▬▬▬▬▬▬▬▬▬▬▬▬▬▬▬▬▬▬▬▬▬▬▬▬▬▬▬▬▬▬▬▬▬▬▬▬▬▬▬▬▬▬▬

AFFIDAVIT OF COMPLIANCE FOR INSURANCE OR OTHER FINANCIAL RESPONSIBILITY

The undersigned (hereinafter referred to as “applicant”) swears that, in compliance with Title 31, Chapter 47 of the General Laws, Motor and Other Vehicles, known as the Motor Vehicles Reparations Act, he/she will not operate or allow to be operated the motor vehicle described in the registration nor other motor vehicle unless all such motor vehicles are covered for financial security.

Because of a concern over the rising toll of motor vehicle accidents and the suffering and loss thereby inflicted, the legislature determined that it is a matter of grave concern that motorists shall be financially able to respond in damages for their negligent acts so that innocent victims of motor vehicle accidents may be compensated for the injury and financial loss inflicted upon them. The aforementioned act was passed to address such concern.

The act requires every natural person, firm, partnership, association or corporation registering a vehicle or renewing the registration a vehicle or renewing the registration of a vehicle to aver that he/she will provide financial security on same.

The obligation will be met by maintaining a policy of liability insurance with bodily injury limits of $25,000 to any one person and $50,000 to two or more persons in any one accident along with a limit of $25,000 for injury to or destruction of property of others in any one accident or a combined bodily and property damage liability limit of $75,000; OR by filing with the assistant director for motor vehicles in the Department of Revenue in the amount of $75,000; OR by qualifying as a self-insurer.

Penalties for failure to comply with the provisions of the act may result in fines and/or suspension of license and registration.

The existence of this act and its requirements does not prevent the possibility that the applicant may be involved in an accident with an owner or operator of a motor vehicle who is without financial responsibility.

▬▬▬▬▬▬▬▬▬▬▬▬▬▬▬▬▬▬▬▬▬▬▬▬▬▬▬▬▬▬▬▬▬▬▬▬▬▬▬▬▬▬▬▬▬▬▬▬▬▬▬▬▬▬

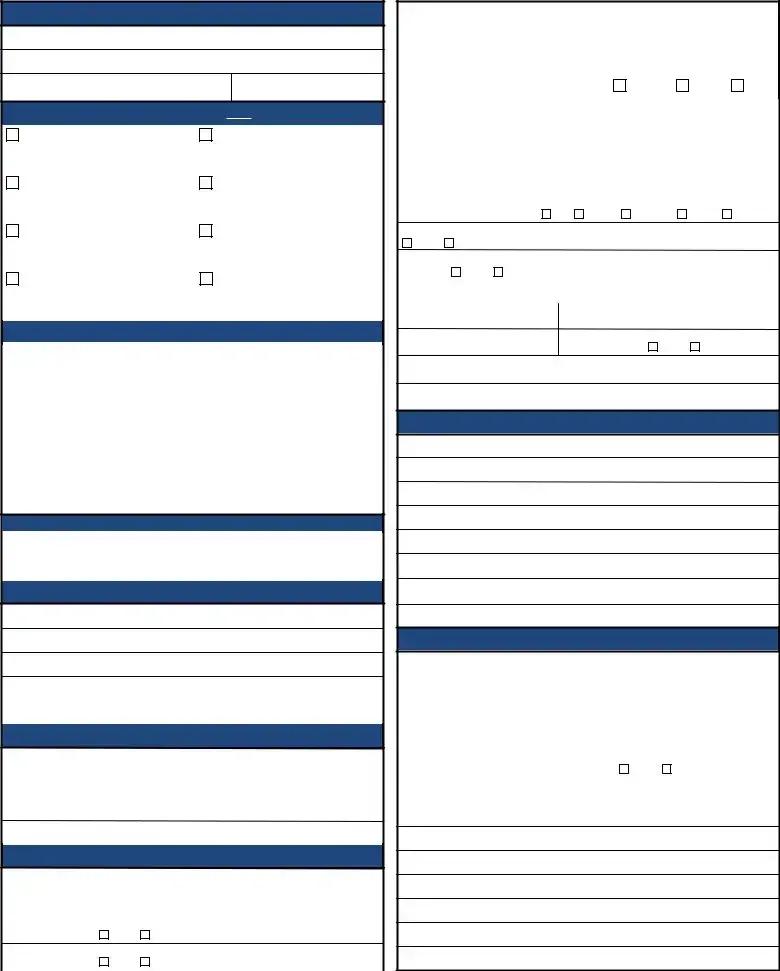

OFFICIAL USE ONLY

CRANSTON Fax Numbers: (401) 462-5785 or (401) 462-5786

SUSPENSIONS:

□ EMISSIONS |

|

□ INCOME TAX BLOCK |

□ CHILD SUPPORT |

□ ADJUDICATION |

|

401-462-5890 (phone) |

401-574-8941 (phone) |

|

401-458-4400 (phone) |

401-462-0800 (phone) |

|

401-462-5838 (fax) |

401-574-8863 (phone) |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

UNPROCESSED WORK |

|

CLERK NAME: ___________________ |

CLERK NUMBER: _____________ |

1. |

Date: |

____________________ |

|

5. Tax |

$______________ |

|

2. |

Reason: |

________________________________________ 6. Title |

$______________ |

|

3. |

Phone: |

____________________ |

|

7. Reg. |

$______________ |

|

4. |

Cash or check: ____________________ |

|

8. Total $______________ |

|

|

|

|

|

|

|

|

|

|

|

FOR ENFORCEMENT OFFICE ONLY |

|

|

|

|

|

|

|

|

|

|

|

|

|

□ IDENTITY ______________________________ |

|

|

|

|

|

|

|

|

|

|

|

|

STAMP |

|

|

|

|

|

|

|

|

□ P.O.R. ______________________________ |

|

|

|

|

|

|

VALID TIL _________________ |

|

|

|

|

|

□ S.S. CARD ______________________________ |

|

DATE |

|

|

|

|

|

DMV OFFICIAL ______________ |

|

|

|

|

□ OTHER ______________________________ |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|