The BOS TC-843 form is comparable to the IRS Form 4506, which allows individuals to request transcripts of their tax returns. Both documents are used to verify information; however, IRS Form 4506 primarily serves for tax records and may be utilized during loan applications or tax disputes. Whereas the TC-843 is a certification of title for a vehicle, it does not apply to income records. Thus, while both forms facilitate the verification process, their purposes and contexts differ significantly.

Another document similar to the BOS TC-843 is the DMV Form H-1. This form is typically used to apply for a title when a vehicle is sold without a title. Like the TC-843, the H-1 serves an essential role in the vehicle transfer process. Both forms ensure that ownership is clearly documented and recognized by authorities, providing legitimacy and protecting against potential fraud.

The Application for Duplicate Title is another related document. It is used when an original vehicle title is lost, destroyed, or stolen. Individuals submit this application to obtain a new title. Similar to the TC-843, it requires detailed information about the vehicle and the owner. Both processes are aimed at securing proper title documentation, although the Application for Duplicate Title specifically addresses loss or destruction of documents.

Form 1-69, known as the Affidavit of Ownership, is also relevant. This form is used to affirm that an individual is the rightful owner of a vehicle when the original title cannot be produced. As with the TC-843, it is a sworn statement that provides assurance concerning ownership claims. While the TC-843 confirms ownership through official channels, the 1-69 allows for personal assurance when documentation lacks.

The Certificate of Title is yet another document comparable to the BOS TC-843. This certificate is issued by the state to prove who owns a vehicle. Similar to the TC-843, the Certificate of Title serves as official proof of ownership. Both documents require vehicle identification details and owner information, highlighting their role in establishing ownership for licensed vehicles.

The Uniform Commercial Code (UCC) Financing Statement is also notable in this context. This document is used to publicly declare a secured party's interest in personal property, including vehicles. Like the TC-843, it establishes proof of interest and protection against claims by creditors. While the UCC statement has a broader application in financing, both serve to clarify ownership and rights pertaining to personal property.

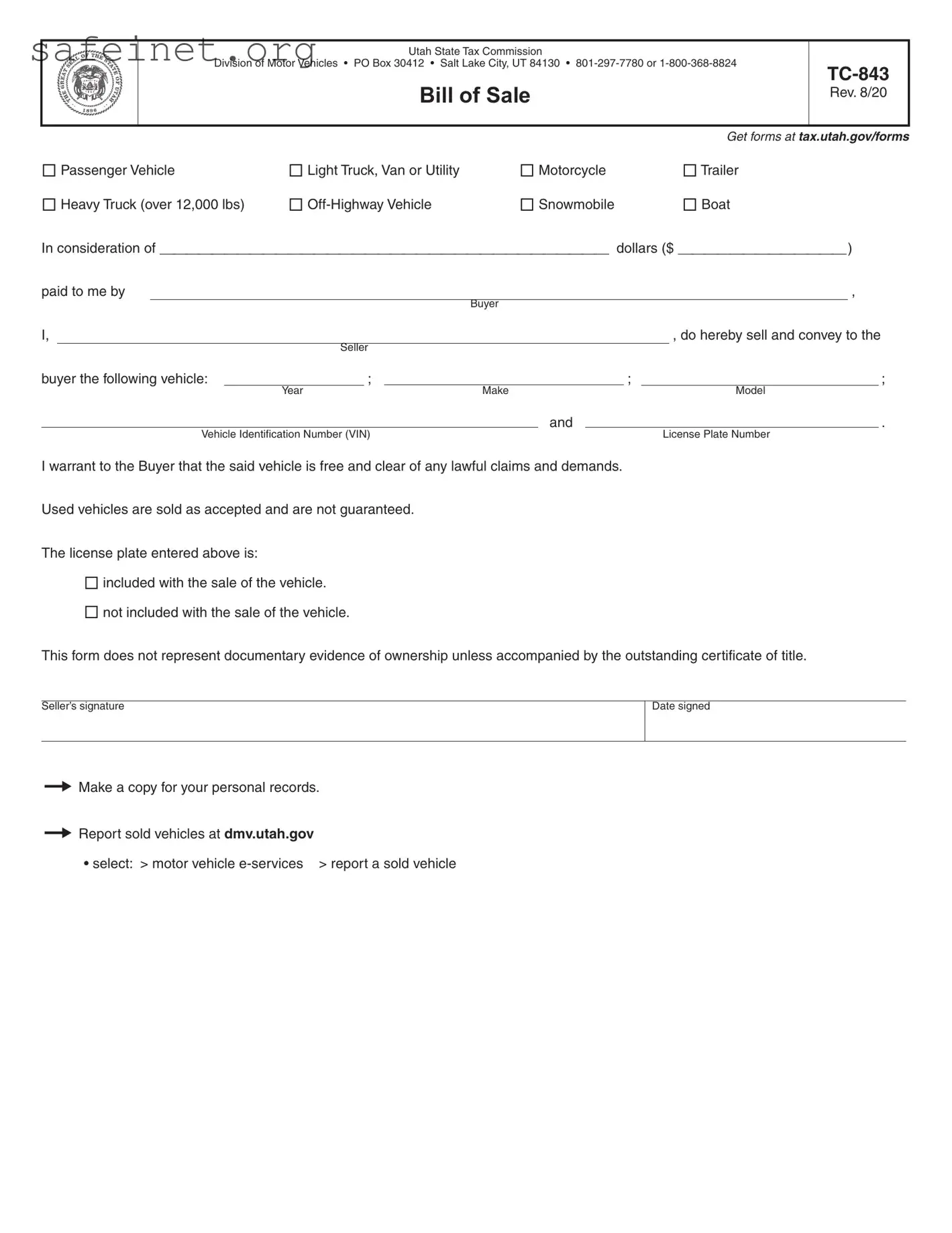

Additionally, the Vehicle Bill of Sale is similar in that it documents the transfer of ownership from seller to buyer. The Bill of Sale outlines key details like the vehicle's identification number and sale price, similar to essential information found on the TC-843. Both documents play critical roles in the transaction process, securing the legal transfer of ownership.

The Manufacturer’s Certificate of Origin (MCO) is comparable as well. This document is provided by the manufacturer to the first purchaser of a vehicle. It serves as the basis for obtaining a title. Both the MCO and TC-843 ensure that the vehicle's ownership and status are clear and recognized by the relevant authorities, albeit at different stages in the vehicle's life cycle.

Form MV-1, the Application for Title or Registration, is another document with similar functions. It is used by individuals to apply for a vehicle title or to register a new or used vehicle with the state. Both forms require the owner to provide essential vehicle details and personal information. Here, the structure supports the legal recognition of the vehicle's ownership.

Finally, the Power of Attorney form for Vehicle Transactions is akin to the TC-843 in its function concerning vehicle ownership changes. This form allows someone to act on behalf of the vehicle owner during the sale or title transfer process. Both documents function to facilitate processes surrounding vehicle ownership and transfer, providing the necessary authority and verification.