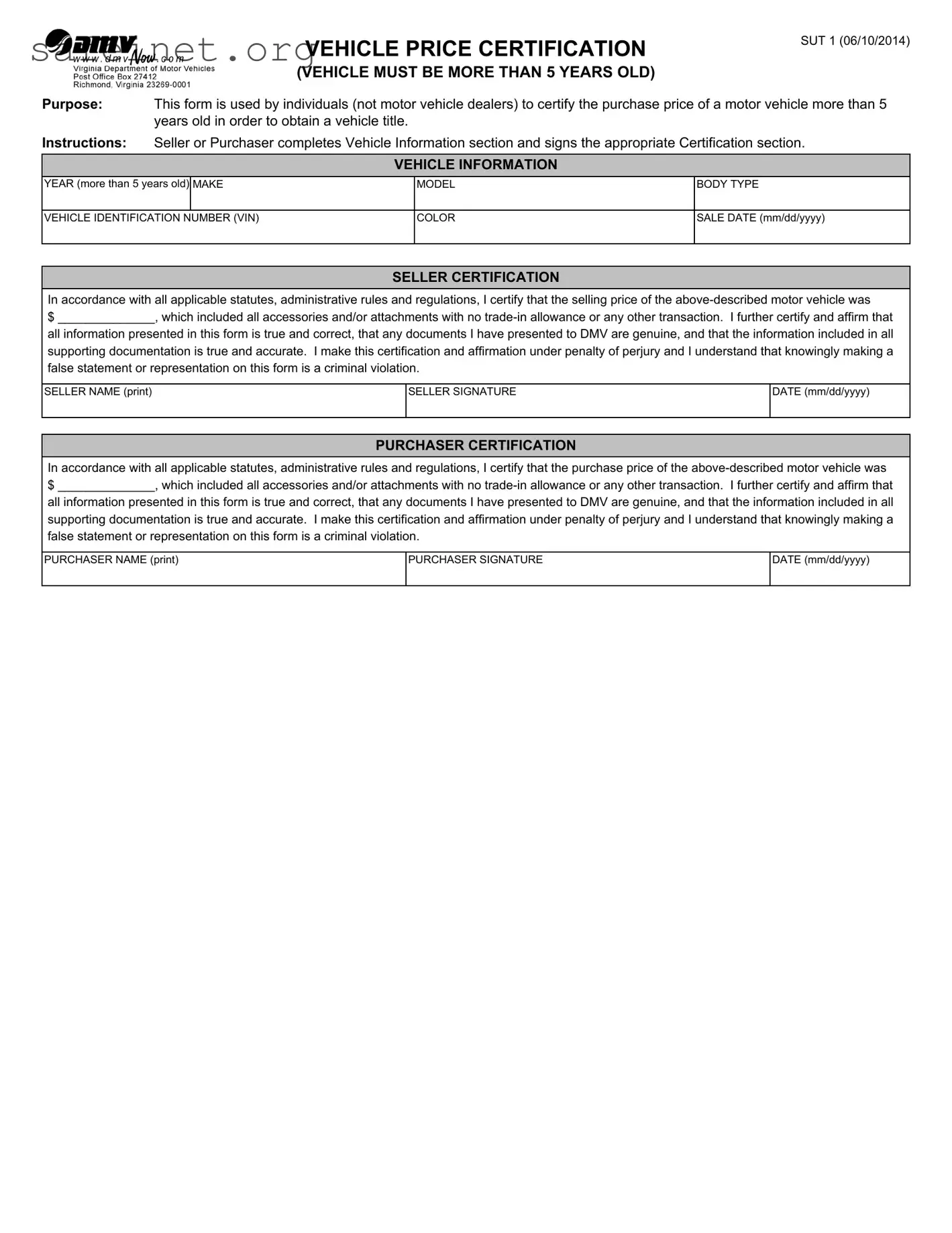

What is the BOS SUT 1 form?

The BOS SUT 1 form is used to report state and local sales tax liabilities in certain jurisdictions. It is a vital document for businesses to maintain compliance with tax regulations. This form helps ensure that all sales transactions are accurately recorded and that the correct amount of sales tax is paid to the appropriate authorities.

Who is required to file the BOS SUT 1 form?

Any business engaging in the sale of tangible personal property or specified services that are subject to sales tax must file the BOS SUT 1 form. This includes brick-and-mortar stores, online retailers, and service providers who charge sales tax. If your business operates in a jurisdiction where this requirement exists, filing this form becomes essential.

When is the BOS SUT 1 form due?

The due date for the BOS SUT 1 form typically aligns with the tax reporting period designated by the state. This could be monthly, quarterly, or annually, depending on the volume of taxable sales a business has. Businesses should check with their state’s tax authority for specific deadlines.

What information is needed to complete the BOS SUT 1 form?

To fill out the BOS SUT 1 form, several pieces of information will be necessary. This includes total sales for the reporting period, the amount of sales tax collected, any exemptions claimed, and additional details about the types of sales made. Accurate record-keeping of sales transactions will aid in gathering the required data.

Can the BOS SUT 1 form be filed electronically?

Many states allow for electronic filing of the BOS SUT 1 form, streamlining the process for businesses. Filing online can expedite processing times and reduce potential errors. However, it’s essential to check with your specific state’s tax department to determine if electronic filing is permitted.

What happens if the BOS SUT 1 form is filed late?

Filing the BOS SUT 1 form after the deadline can result in penalties and interest being assessed by the state. The severity of these penalties often depends on how late the form is submitted. To avoid such issues, businesses should prioritize timely filing and may want to set reminders for upcoming deadlines.

What are common mistakes to avoid when completing the BOS SUT 1 form?

Common mistakes when filling out the BOS SUT 1 form include inaccurate reporting of total sales, miscalculating the sales tax owed, failing to include all applicable exemptions, and not signing the form if required. Double-checking calculations and ensuring all necessary information is included can help minimize errors.

Is there a process for amending a BOS SUT 1 form?

Yes, if a business discovers an error after submitting the BOS SUT 1 form, it may be possible to amend it. The process usually involves filling out a specific amendment form or contacting the state’s tax department for guidance on correcting the submitted information. It’s important to act quickly, as delays may increase potential penalties.

Where can I get help if I have questions about the BOS SUT 1 form?

If questions arise regarding the BOS SUT 1 form, businesses should reach out to their state’s tax department for assistance. Most states provide resources, including hotlines and written guides, to help taxpayers understand their responsibilities. Consulting a tax professional can also prove beneficial for more complex situations.

What should I do if I can’t pay the sales tax owed?

If a business is unable to pay the sales tax owed by the submission deadline, it is crucial to still file the BOS SUT 1 form on time to avoid additional penalties for late filing. After submitting the form, reaching out to the state tax authority can provide options, such as payment plans or arrangements, to address the outstanding balance.