What is the BOS RUT-49 form?

The BOS RUT-49 form is used in the state of California for the purpose of reporting a vehicle's use for business purposes. It allows individuals and businesses to disclose information about the vehicle they use for their operations, ensuring compliance with state regulations regarding the taxation of vehicle usage.

Who needs to fill out the BOS RUT-49 form?

Individuals and businesses that use a vehicle for business purposes in California must fill out the BOS RUT-49 form. This includes vehicle owners who claim a deduction for business use on their tax returns or those required to report vehicle use to the California Department of Tax and Fee Administration.

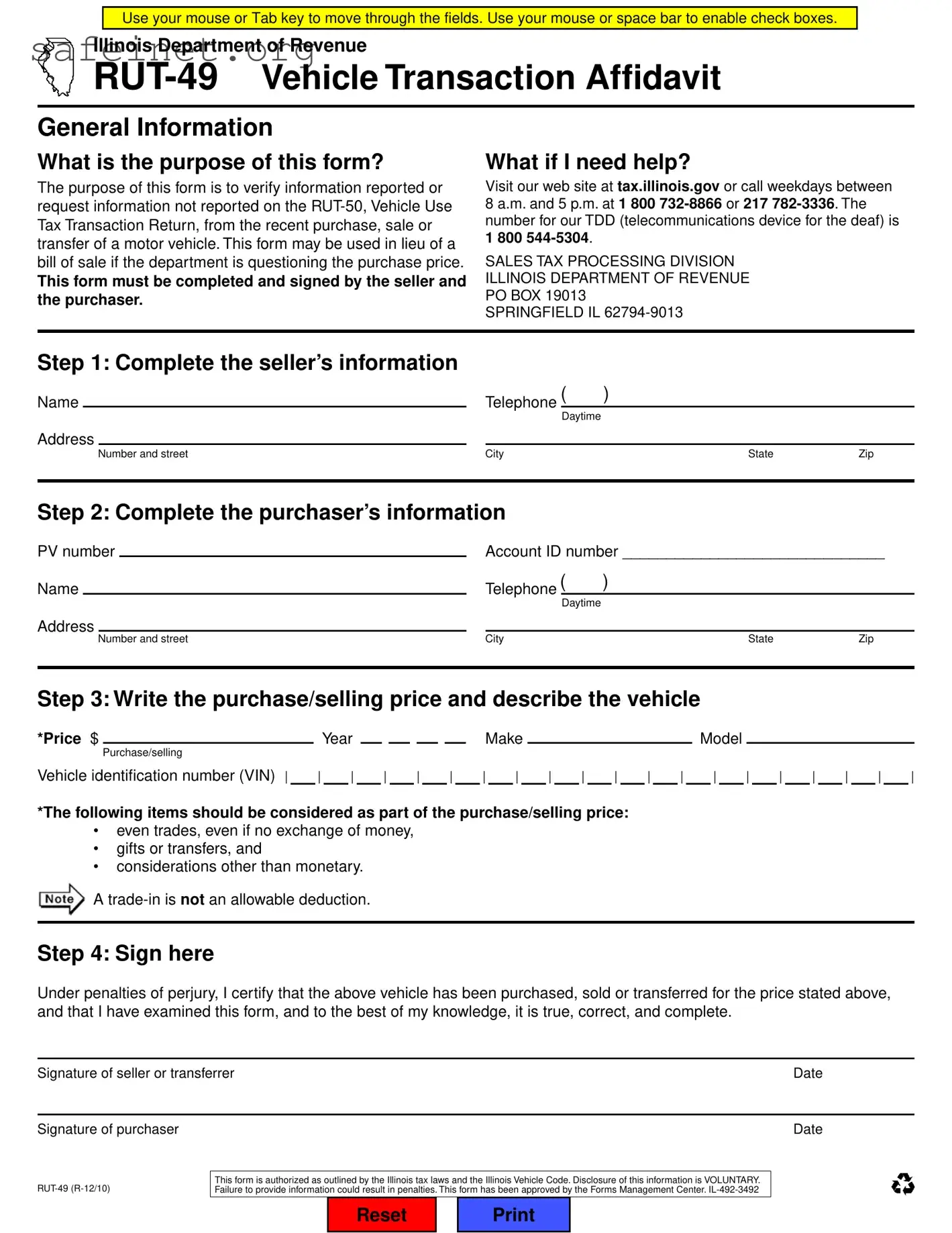

How do I complete the BOS RUT-49 form?

To complete the BOS RUT-49 form, gather all necessary information regarding the vehicle and its usage. This includes the vehicle identification number (VIN), the business name, the owner's information, and how the vehicle is used for business. Follow the prompts on the form, ensuring that each section is filled out accurately. If you have questions, reference the instructions provided with the form or seek assistance from a tax professional.

Is there a deadline for submitting the BOS RUT-49 form?

Yes, the deadline for submitting the BOS RUT-49 form typically coincides with the end of the tax year for individuals and businesses. It is essential to submit the form on or before the deadline to avoid any potential penalties or issues with reporting vehicle use for tax purposes.

Can I submit the BOS RUT-49 form electronically?

The BOS RUT-49 form can be submitted electronically in certain circumstances. Check the California Department of Tax and Fee Administration’s website for information about electronic filing options or if your specific situation qualifies for such submission.

What should I do if I make a mistake on the BOS RUT-49 form?

If an error is discovered after submission, contact the California Department of Tax and Fee Administration as soon as possible. They can provide guidance on how to correct the mistake. In many cases, submitting an amended form may be required to accurately reflect the information.

Is there a fee associated with the BOS RUT-49 form?

There is no fee for submitting the BOS RUT-49 form itself. However, ensure you are aware of any tax implications related to the vehicle’s business use, as these could impact your overall tax obligations.

What are the consequences of not filing the BOS RUT-49 form?

Failure to file the BOS RUT-49 form may result in penalties and interest charges. Inaccurate reporting can also lead to audits or discrepancies in business tax filings. Therefore, it is crucial to complete and submit this form accurately and on time.

Where can I find the BOS RUT-49 form?

The BOS RUT-49 form can be downloaded from the California Department of Tax and Fee Administration's website. Physical copies may also be available at local government offices or tax services. Ensure you have the most current version of the form when you download or request it.

A

A