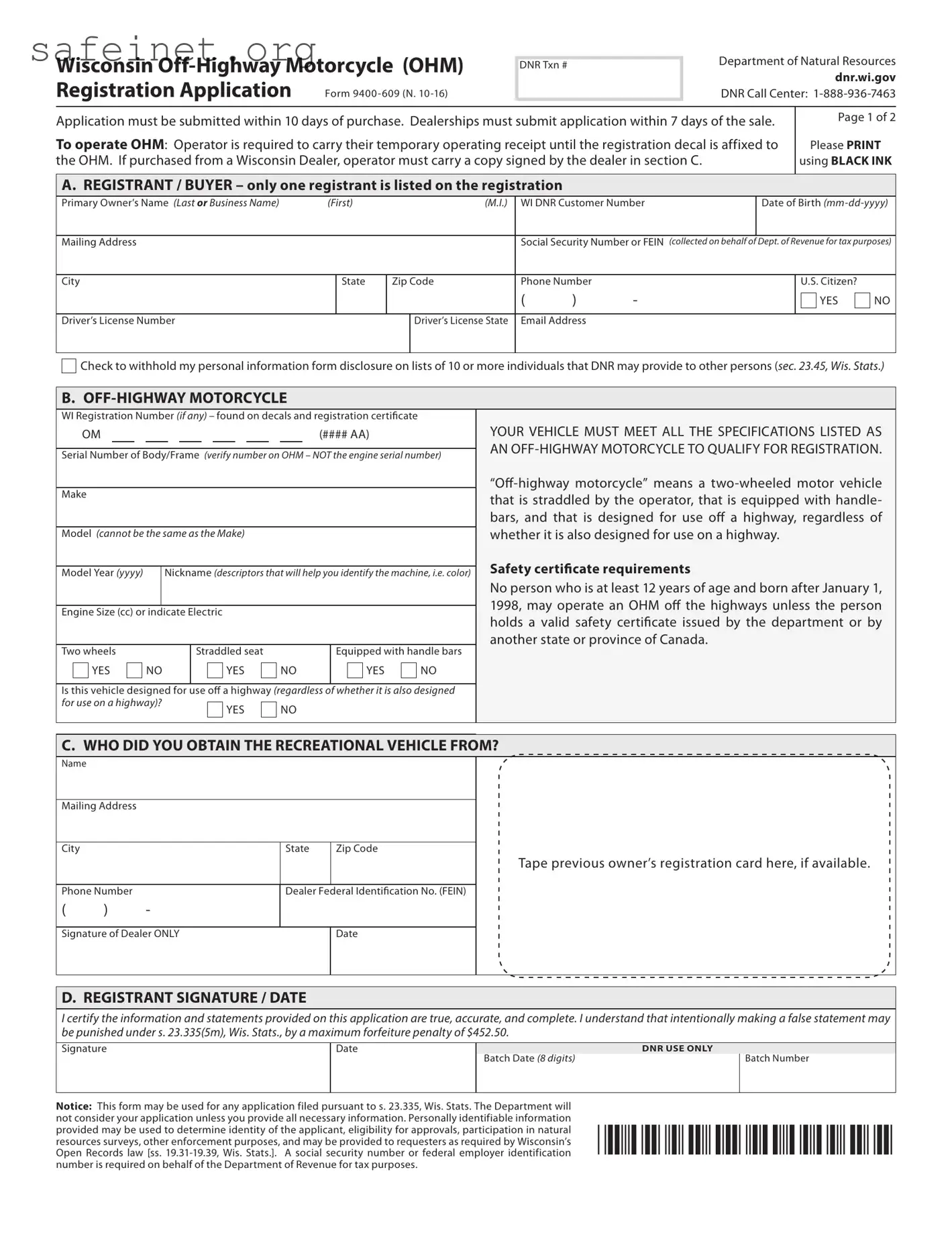

What is the BOS 9400-609 form?

The BOS 9400-609 form is a document utilized in specific administrative processes within certain government or organizational contexts. It serves to gather essential data necessary for processing various applications or requests. Often, the form is required for compliance with regulations and helps ensure that all information submitted meets required standards.

Who needs to fill out the BOS 9400-609 form?

This form is typically required from individuals or organizations that are participating in a process governed by the relevant authorities. Depending on the specific context, it may be required from applicants seeking permits, licenses, or other official acknowledgments. Review the instructions associated with the form to determine if it applies to your particular situation.

How do I obtain the BOS 9400-609 form?

The BOS 9400-609 form can usually be obtained online through the relevant government agency's website or from designated office locations. Some organizations may provide downloadable versions of the form, making it easily accessible. If you face difficulties finding the form, consider contacting the office directly to request assistance.

What information do I need to provide on the BOS 9400-609 form?

When completing the BOS 9400-609 form, you will likely be required to input personal details, such as name, address, and contact information. Additionally, the form may ask for specific information relevant to the application or request you are making. It's important to provide accurate and honest information to avoid delays in processing.

Is there a deadline for submitting the BOS 9400-609 form?

Submission deadlines for the BOS 9400-609 form may vary depending on the nature of your request and the specific government or organizational guidelines. It's crucial to be aware of these deadlines as failing to submit the form on time could result in delays or denial of your application. Always check the guidelines associated with your submission for exact dates.

Can the BOS 9400-609 form be submitted online?

Depending on the agency's procedures, the BOS 9400-609 form may or may not have an online submission option. Some agencies have moved to digital submissions to streamline the process, while others still require physical copies. Review the agency’s specific instructions to determine the available submission methods.

What should I do if I make a mistake on the BOS 9400-609 form?

If you realize that you've made a mistake on the form after submission, contact the relevant office as soon as possible to inquire about the best course of action. In many cases, you may be able to submit a corrected version of the form or provide additional information to rectify the error efficiently.

Are there any fees associated with the BOS 9400-609 form?

Fees may be associated with the submission of the BOS 9400-609 form, depending on the nature of your request and the agency involved. For instance, certain applications may require a processing fee. Be sure to check the specific fee schedule related to your submission to ensure you meet all financial obligations.

How will I know the status of my submission after sending in the BOS 9400-609 form?

Once the BOS 9400-609 form is submitted, most agencies will provide a method for tracking its status. This may include confirmation emails, reference numbers, or online tracking systems. If you do not receive any confirmation or if you're uncertain about the status, don’t hesitate to reach out to the agency for updates.

What should I do if my application is denied after submitting the BOS 9400-609 form?

If your application is denied, the agency will typically provide a reason for the denial. It’s helpful to carefully review that information. If you believe the denial was in error or if you’d like to appeal the decision, follow the instructions provided by the agency for appeals or reconsiderations. This process will often be outlined in the denial notification.

Check to withhold my personal information form disclosure on lists of 10 or more individuals that DNR may provide to other persons (

Check to withhold my personal information form disclosure on lists of 10 or more individuals that DNR may provide to other persons (

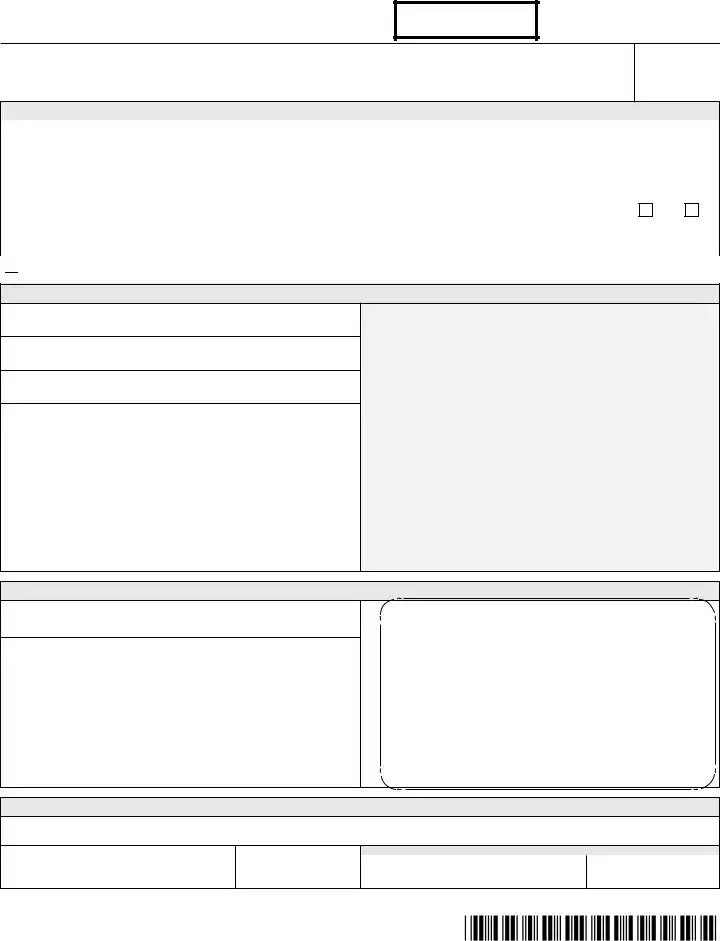

P = If purchased from your parent, stepparent,

P = If purchased from your parent, stepparent,

S = If purchased from your spouse;

S = If purchased from your spouse;

C = If purchased from your child, stepchild,

C = If purchased from your child, stepchild,

NEW Public Wisconsin Registration

NEW Public Wisconsin Registration