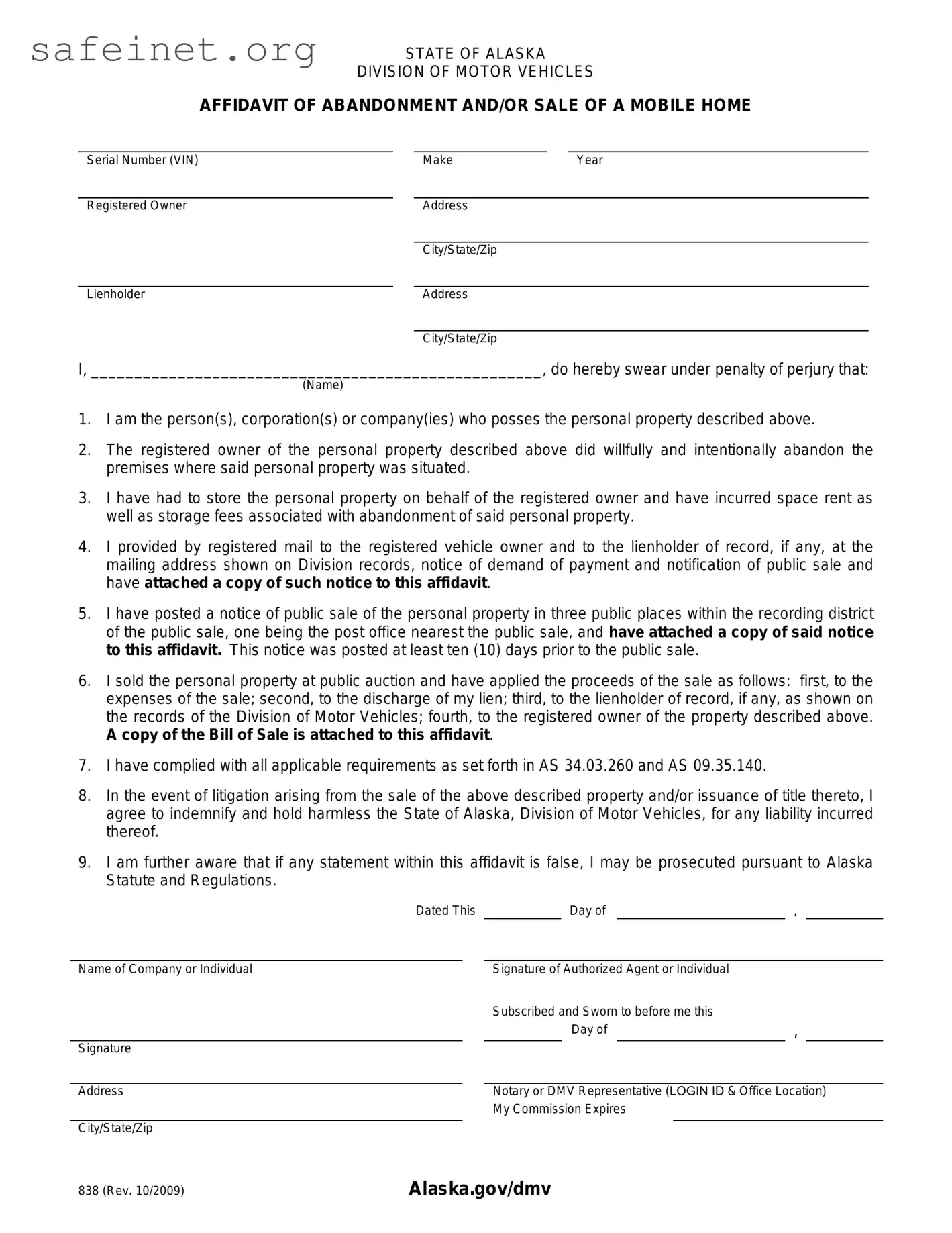

What is the BOS 838 form?

The BOS 838 form is a specific document used for various purposes that may involve a certain government agency or program. While the exact details of the form can vary depending on the context, it typically serves as a tool to collect information relevant to administrative processes, compliance, or reporting requirements.

Who needs to fill out the BOS 838 form?

Individuals or entities that are involved in a situation requiring the BOS 838 form must complete it. This can include professionals from certain industries, organizations receiving government funding, or individuals seeking a benefit or service governed by this form.

Where can I obtain the BOS 838 form?

The BOS 838 form can generally be found on the official website of the agency or organization that requires it. Many government forms are available for download in PDF format, making them accessible to anyone who needs them. Checking the agency's website is the best starting point.

What information is typically required on the BOS 838 form?

While the specific details may vary, the BOS 838 form often requires basic identifying information. This can include names, addresses, contact details, and possibly financial or organizational data. Always refer to the instructions provided with the form for complete requirements.

Is there a deadline for submitting the BOS 838 form?

Yes, deadlines for submitting the BOS 838 form can exist. These may depend on the specific agency's requirements or the purpose of the form. It is crucial to check the guidelines associated with the form to avoid any issues with late submissions, which could lead to delays or complications.

Can I submit the BOS 838 form electronically?

Whether the BOS 838 form can be submitted electronically often depends on the agency handling it. Many agencies are shifting to online submission systems, but others may still require physical copies. Reviewing the submission options available on the agency's website will provide the most accurate information.

What happens after I submit the BOS 838 form?

After submitting the BOS 838 form, the agency will review the information provided. They may reach out for additional clarification or documentation if needed. Processing times can vary widely, so it is advisable to check with the agency for expected timelines related to your submission.

Are there any fees associated with the BOS 838 form?

Fees may or may not be associated with the submission of the BOS 838 form. It is important to verify with the agency if there is a cost involved. Be it filing fees or service fees, clear information should be available on the agency's website.

What should I do if I make a mistake on the BOS 838 form?

If a mistake is made on the BOS 838 form, it is generally best to correct it before submission. If it has already been submitted, contact the relevant agency as soon as possible to inquire about their correction procedure. Many agencies have established protocols for handling errors in submitted documents.

Where can I find help if I have questions about the BOS 838 form?

If questions arise regarding the BOS 838 form, the appropriate agency is usually the best place to seek help. Many agencies provide customer service or technical assistance through phone lines or email support. Sometimes, they also offer FAQs or resources on their website that can provide immediate answers.