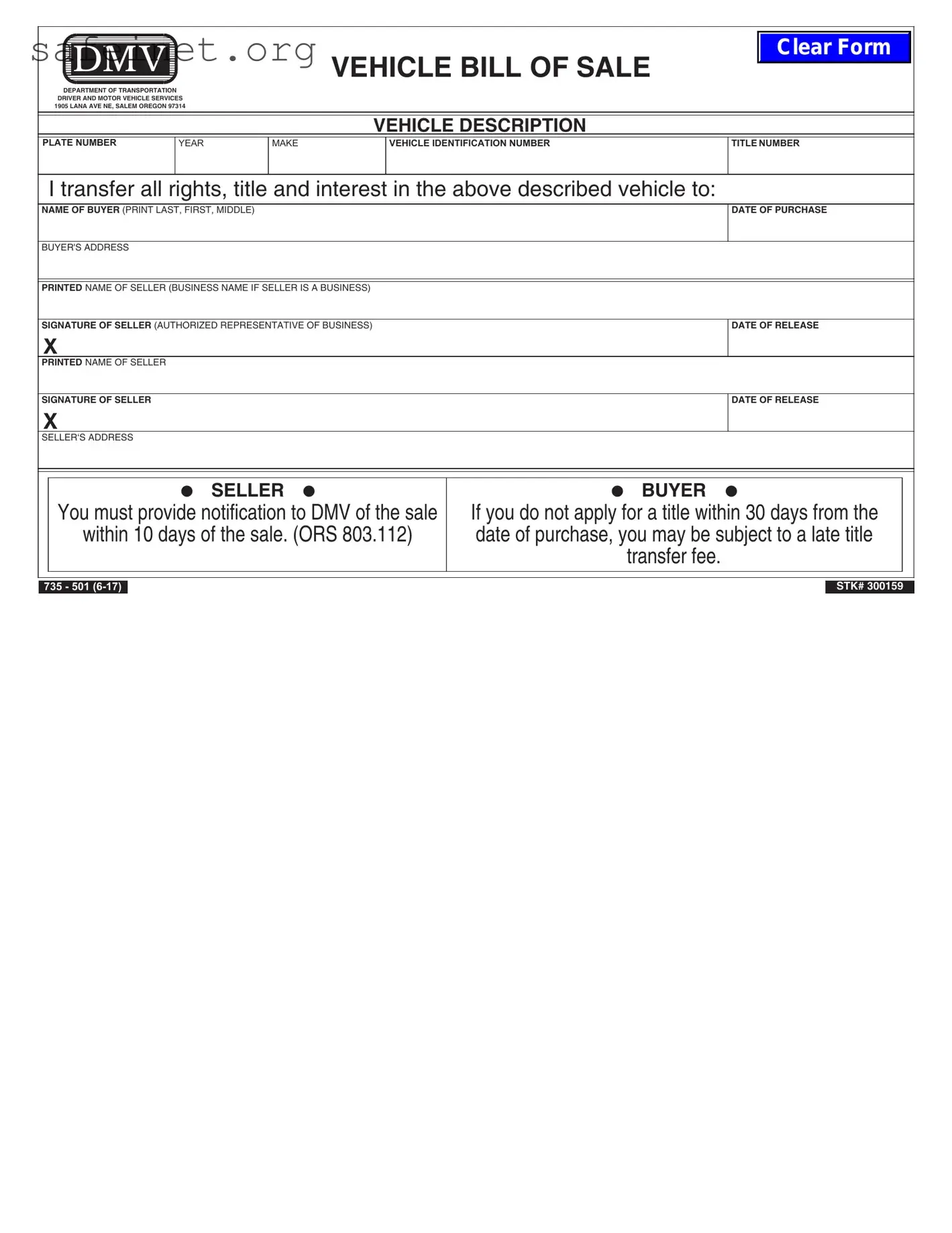

What is the BOS 735-501 form?

The BOS 735-501 form is a document used in specific legal situations. It may pertain to a variety of purposes depending on the context in which it is utilized. Ensure you have the correct form as it is designed for particular transactions or purposes within legal frameworks.

Who needs to fill out the BOS 735-501 form?

Individuals or entities involved in a legal matter that requires the BOS 735-501 form must complete it. This may include property owners, tenants, or representatives acting on behalf of another party in legal or administrative proceedings.

When is the BOS 735-501 form required?

The form may be required at different stages of a legal transaction, often during the filing process for specific claims or applications. It is important to consult relevant authorities or legal advisors to determine the exact timing for submission.

How do I obtain the BOS 735-501 form?

The BOS 735-501 form can typically be obtained from the relevant government agency or legal office associated with its use. Many forms can also be downloaded from official websites, which often provide guidance on how to complete them correctly.

What information do I need to provide on the BOS 735-501 form?

Required information often includes personal details of the individual or entity filling out the form, relevant case or transaction information, and any necessary signatures. It is crucial to read the form’s instructions carefully to ensure all required fields are addressed.

Can I submit the BOS 735-501 form online?

Submission methods for the BOS 735-501 form vary by jurisdiction. Some areas may allow online submissions, while others require the form to be mailed or submitted in person. Check the guidelines provided by the relevant authority for details on acceptable submission methods.

What happens after I submit the BOS 735-501 form?

After submission, the form will typically be reviewed by the appropriate officials. They will assess the information and determine the next steps in the legal process. You may receive notifications or correspondence regarding the status of your submission.

Are there any fees associated with the BOS 735-501 form?

Fees for submitting the BOS 735-501 form can vary based on the jurisdiction and specific legal requirements. It is advisable to confirm whether any fees apply and what payment methods are accepted prior to submission.

What should I do if I make a mistake on the BOS 735-501 form?

If an error is discovered after the form has been submitted, contact the relevant authority as soon as possible. They will provide guidance on whether you need to submit a corrected form or take other corrective action.