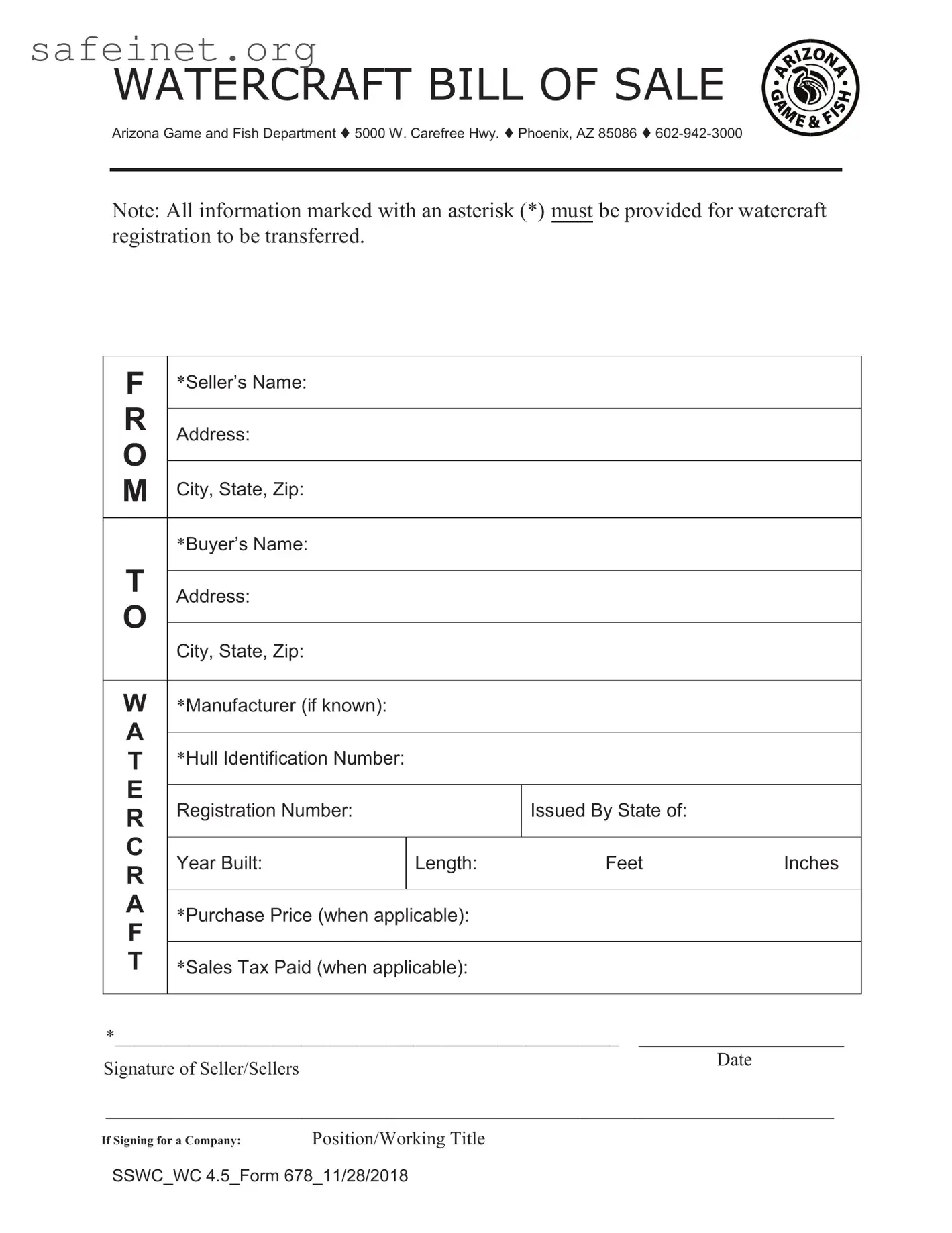

What is the BOS 678 form?

The BOS 678 form is primarily used in the context of business transactions, serving as a declaration or statement that may be needed for various legal or financial processes. It's designed to capture essential information related to business operations, agreements, or other official documents.

Who should fill out the BOS 678 form?

Any individual or organization involved in a business transaction that requires official documentation may need to complete the BOS 678 form. This could include business owners, partners, or representatives involved in contractual obligations.

When is the BOS 678 form required?

The necessity of the BOS 678 form often arises in specific situations, such as when entering into a new partnership, seeking financing, or formally documenting changes within a business. It's essential to check the particular requirements for your situation.

How do I fill out the BOS 678 form?

Filling out the BOS 678 form typically involves providing basic information about the business, the parties involved, and the nature of the transaction. Be thorough and accurate, as incomplete or unclear information can lead to delays or issues later on.

Where can I obtain the BOS 678 form?

You can usually find the BOS 678 form on the official website of the relevant state business or financial authority. Many agencies also provide the form at their physical locations, or they may even offer the option to request it via mail.

Is there a fee associated with submitting the BOS 678 form?

Submitting the BOS 678 form may incur a fee, but this varies depending on the jurisdiction and the specifics of your situation. It’s advisable to check the details provided by the agency where you submit the form to understand any associated costs.

What happens if I make a mistake on the BOS 678 form?

If you make an error when filling out the BOS 678 form, corrections can often be made, but it’s essential to follow the procedures outlined by the agency. Depending on the nature of the mistake, you may need to resubmit the form or include a correction letter.

How long does it take to process the BOS 678 form?

The processing time for the BOS 678 form can vary significantly. Generally, you can expect a response within a few weeks, but it often depends on the workload of the agency and the specifics of your submission.

Can I submit the BOS 678 form online?

Some states allow for online submission of the BOS 678 form. Check with your local business authority to see if this is an option. Online submissions can make the process more convenient and quicker.

Whom can I contact if I need help with the BOS 678 form?

If you need assistance with the BOS 678 form, reach out to the business authority or agency responsible for processing the form. They can provide guidance and clarify any questions you may have regarding the completion or submission process.