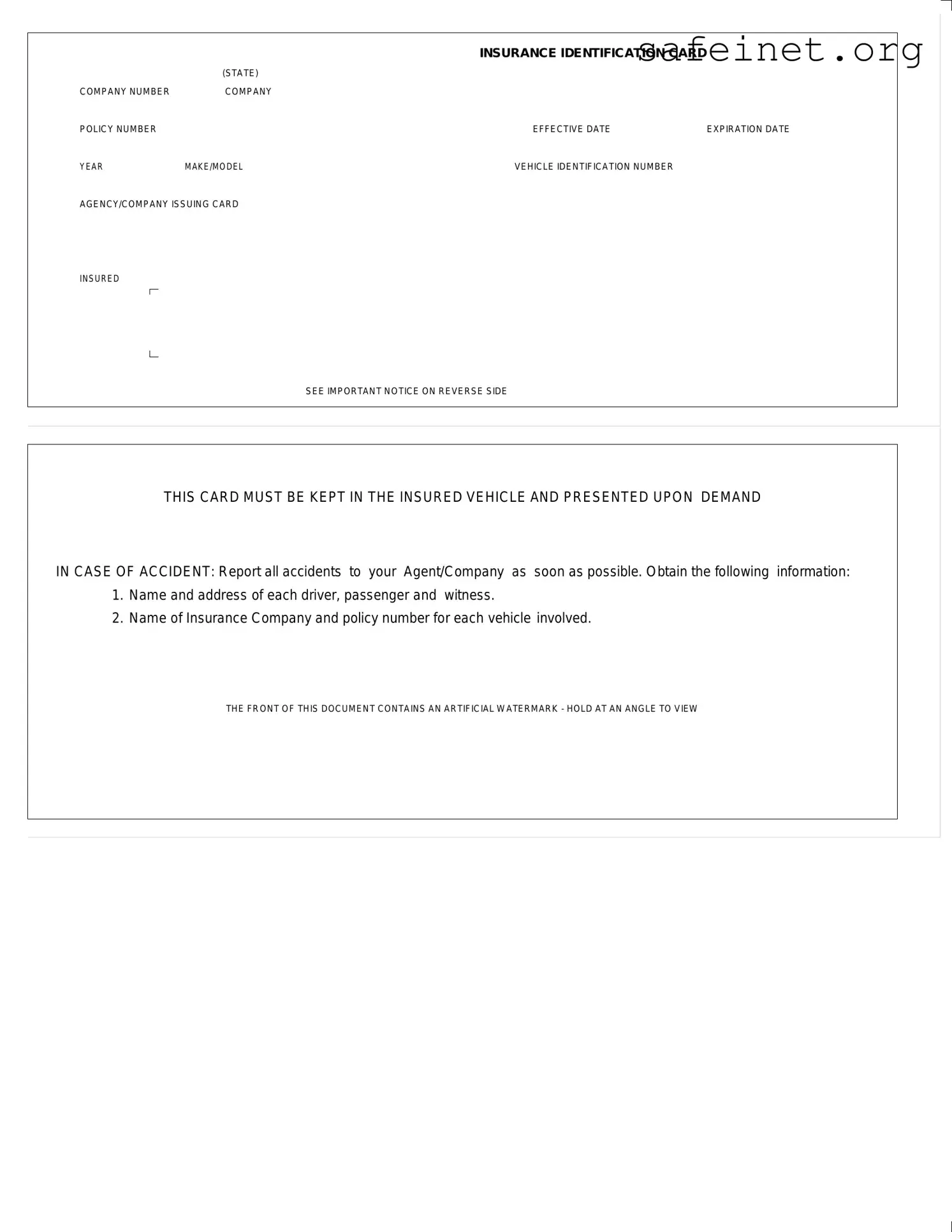

What is an Auto Insurance Card?

An Auto Insurance Card is an official document provided by your insurance company. It serves as proof that you have auto insurance coverage. This card includes essential information such as your company number, policy number, and the details of your vehicle. It’s important to carry this card while driving.

Why do I need to carry the Auto Insurance Card?

Carrying your Auto Insurance Card is required by law in most states. If you are stopped by law enforcement or involved in an accident, you must present this card. It verifies that you are insured, which is crucial for legal and financial protection.

What information is included on the Auto Insurance Card?

The card contains several key pieces of information. It lists your insurance company’s name and contact details, your policy number, the effective and expiration dates of your coverage, details about your vehicle (year, make, model, and identification number), and the agency that issued the card. This information is vital for anyone needing to contact your insurer.

What should I do if I lose my Auto Insurance Card?

If you lose your Auto Insurance Card, reach out to your insurance company as soon as possible. They can issue a replacement card, which you should keep in your vehicle. It’s important never to drive without proof of insurance, so obtaining a new card promptly is wise.

What happens if I forget to carry my Auto Insurance Card?

Forgetting to carry your Auto Insurance Card can lead to penalties, including fines or even a suspension of your driver’s license, depending on state laws. If you do forget it during a traffic stop, explain the situation to the officer. They may verify your coverage through other means, but it’s best to have the card on hand.

What should I do after an accident?

If you are involved in an accident, first ensure everyone’s safety and then report the incident to your insurance company. Gather information from all parties involved, including names, addresses, and insurance details. This information will help with any claims process and is essential for your records.

Is there any important notice on the reverse side of the card?

Yes, the reverse side of the Auto Insurance Card contains an important notice. It advises you to keep the card in your insured vehicle at all times and details what to do in case of an accident. This includes the need to gather information from others involved and report the accident to your agent or insurance company as soon as possible.