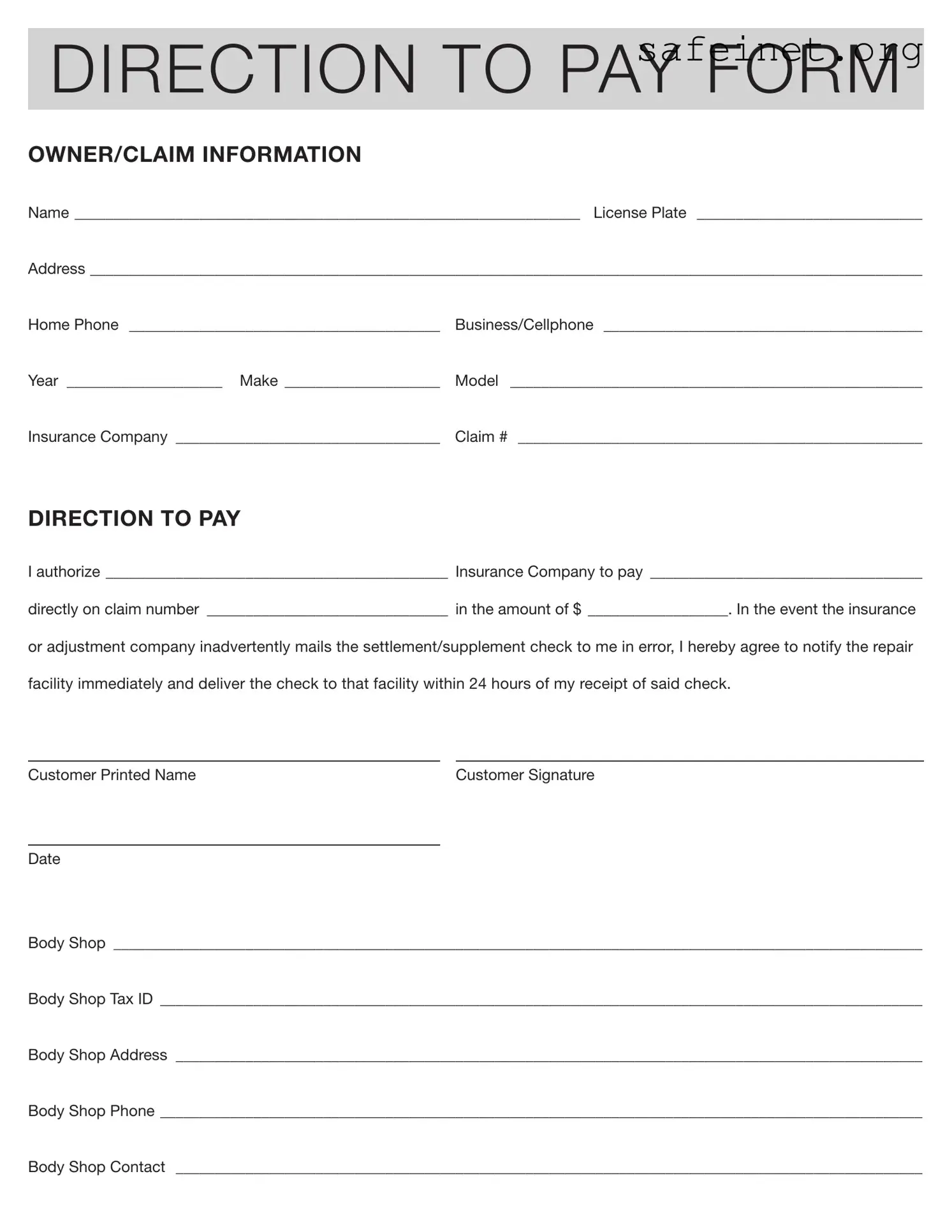

The Authorization and Direction Pay form is reminiscent of a Power of Attorney document. Both forms contain provisions that empower one party to act on behalf of another. In this case, the Authorization and Direction Pay form allows the insurance company to pay a repair facility directly. Similarly, a Power of Attorney authorizes an individual to make decisions on behalf of another individual, often in financial or legal matters. While the purposes may differ, both documents establish a clear agent-principal relationship.

Another similar document is the Assignment of Benefits form. This form permits a policyholder to transfer their insurance benefits to a third party, such as a service provider. Just as the Authorization and Direction Pay form directs payment from the insurance company to a repair facility, the Assignment of Benefits allows for seamless transactions between an insurer and a service provider. This document also improves efficiency by minimizing delays in receiving payment for services rendered.

The Release of Liability form shares a commonality with the Authorization and Direction Pay form in terms of liability management. While the former is typically used to protect one party from legal claims, both forms require a signature from the involved parties. The release absolves the service provider from future claims related to the services provided, just as the Authorization and Direction Pay form stipulates the payment direction and responsibilities concerning checks received by the claimant.

The Claim Form is another closely related document. Like the Authorization and Direction Pay form, it is submitted for processing insurance claims. The Claim Form captures all relevant details that the insurance company needs to assess a claim, such as the incident description, damages, and parties involved. While the Authorization and Direction Pay form focuses on directing payment, both provide essential information that facilitates the claims process.

A Service Agreement also shares similarities with the Authorization and Direction Pay form. This document outlines the terms of service between a service provider and a client. It includes payment terms, scope of work, and other responsibilities. The Authorization and Direction Pay form indicates the amount to be paid to the repair facility, resembling how a Service Agreement specifies the payment expectations between parties.

The Subrogation Agreement allows for the transfer of rights from the insured to the insurer after a claim is settled. Similar to the Authorization and Direction Pay form, which establishes who receives payment, the Subrogation Agreement delineates the relationship between the involved parties regarding claims payments. This document enables the insurer to pursue recovery from the responsible party after compensating the insured.

Additionally, the Payment Authorization form is comparable to the Authorization and Direction Pay form. Both documents serve to provide consent for a financial transaction. In the Payment Authorization form, the signer permits a specific entity to withdraw or charge a designated amount from their account. Likewise, the Authorization and Direction Pay form allows the insurance company to execute a payment to a repair facility, establishing an agreed-upon financial transaction.

The Direct Deposit Authorization form also has ties to the Authorization and Direction Pay form. It provides permission for regular deposits to be made into a designated account without requiring further approval each time. In the same way, the Authorization and Direction Pay form establishes a clear directive for the insurance payment process, allowing for streamlined financial transactions without needing additional invoicing steps.

Lastly, the Indemnity Agreement can be seen as related to the Authorization and Direction Pay form, as both documents intend to protect parties involved in a financial transaction. An Indemnity Agreement involves one party agreeing to compensate the other for any losses or damages incurred. Similarly, the Authorization and Direction Pay form includes a clause where the signer agrees to notify the repair facility should an insurance check be mistakenly sent to them, thereby providing clarity on obligations after the transaction begins.