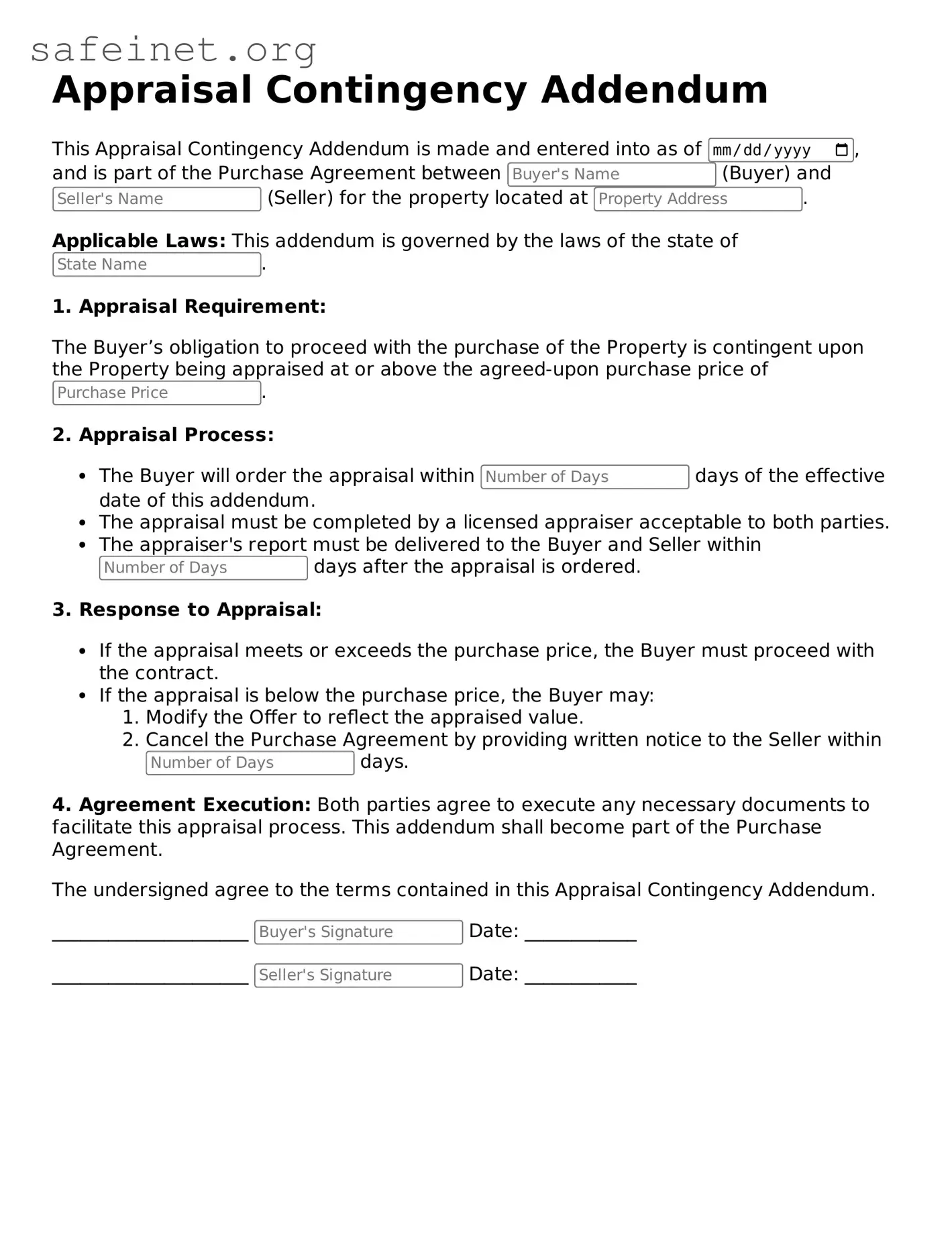

Official Appraisal Contingency Addendum Document

The Appraisal Contingency Addendum is a crucial document used in real estate transactions, designed to protect buyers by ensuring that a property's value matches or exceeds the agreed-upon purchase price. This form serves as a safeguard, allowing buyers to negotiate or walk away if the appraised value falls short. Understanding the implications of this addendum can aid both buyers and sellers in making informed decisions.

To get started on your journey, fill out the Appraisal Contingency Addendum form by clicking the button below.