What is an ADP Pay Stub?

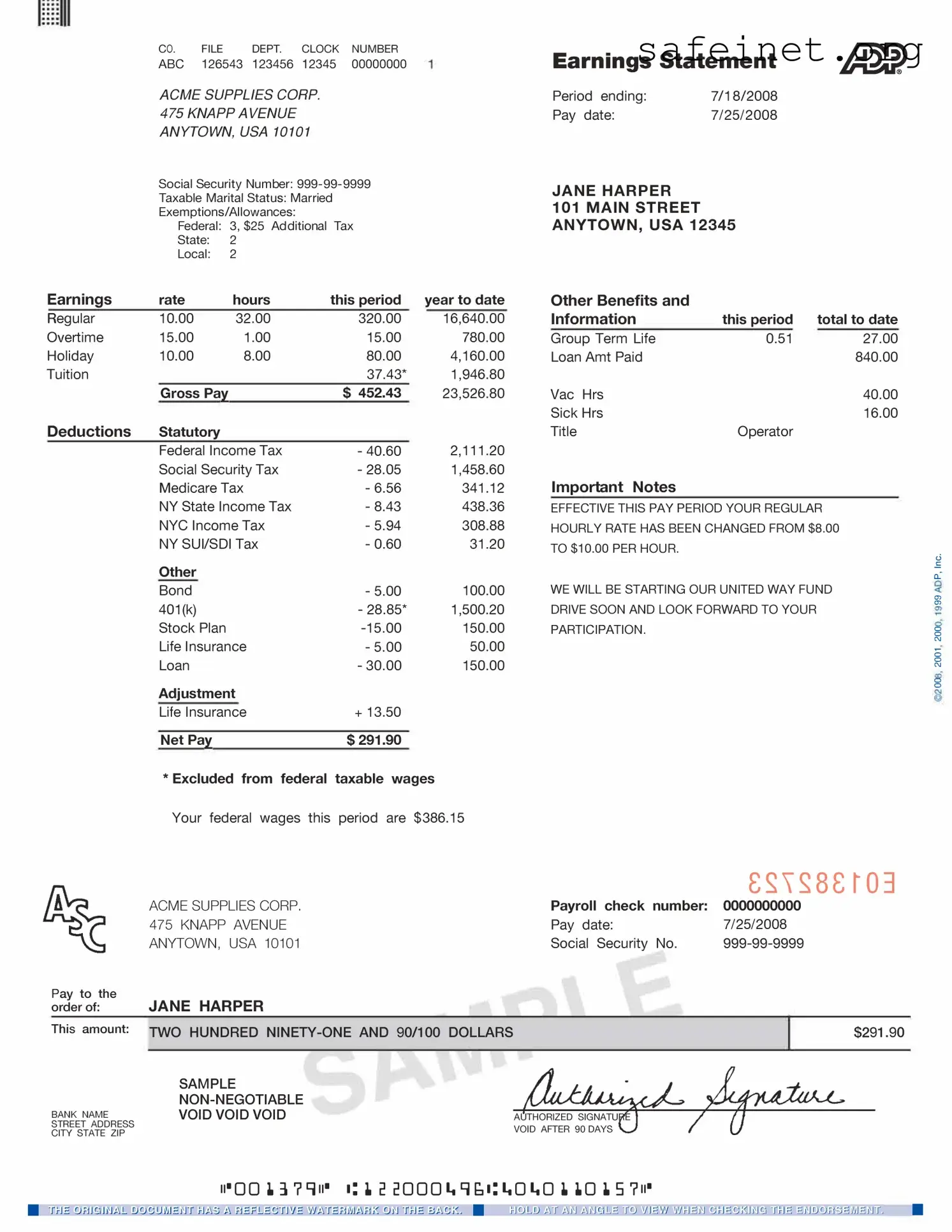

An ADP Pay Stub is a document provided by ADP, a payroll services company, that outlines the details of an employee's pay for a specific pay period. It includes information such as gross earnings, deductions, taxes withheld, and the net pay that the employee will receive. This document is essential for employees to understand their earnings and to keep track of their financial records.

How can I access my ADP Pay Stub?

You can access your ADP Pay Stub online through the ADP portal. First, you'll need to create an account or log in if you already have one. After logging in, navigate to the “Pay” section, where you can view your pay stubs for different pay periods. If you’re having trouble accessing the portal, your employer's HR department can provide assistance.

Why are there deductions shown on my Pay Stub?

Deductions on your Pay Stub are amounts taken out of your gross pay to cover various expenses, such as federal and state taxes, Social Security, Medicare, and any benefits you may have elected, like health insurance or retirement contributions. It is important to review these deductions to understand how much of your earnings is allocated to each category, ensuring that you are aware of your overall financial picture.

What should I do if there is an error on my Pay Stub?

If you notice an error on your Pay Stub, such as incorrect hours worked or wrong deductions, it’s crucial to address it promptly. Start by speaking with your supervisor or HR department. They can assist you in verifying the information and correcting any mistakes. It's always advisable to keep a record of your communications for reference.