What is the 52 Week Money Challenge?

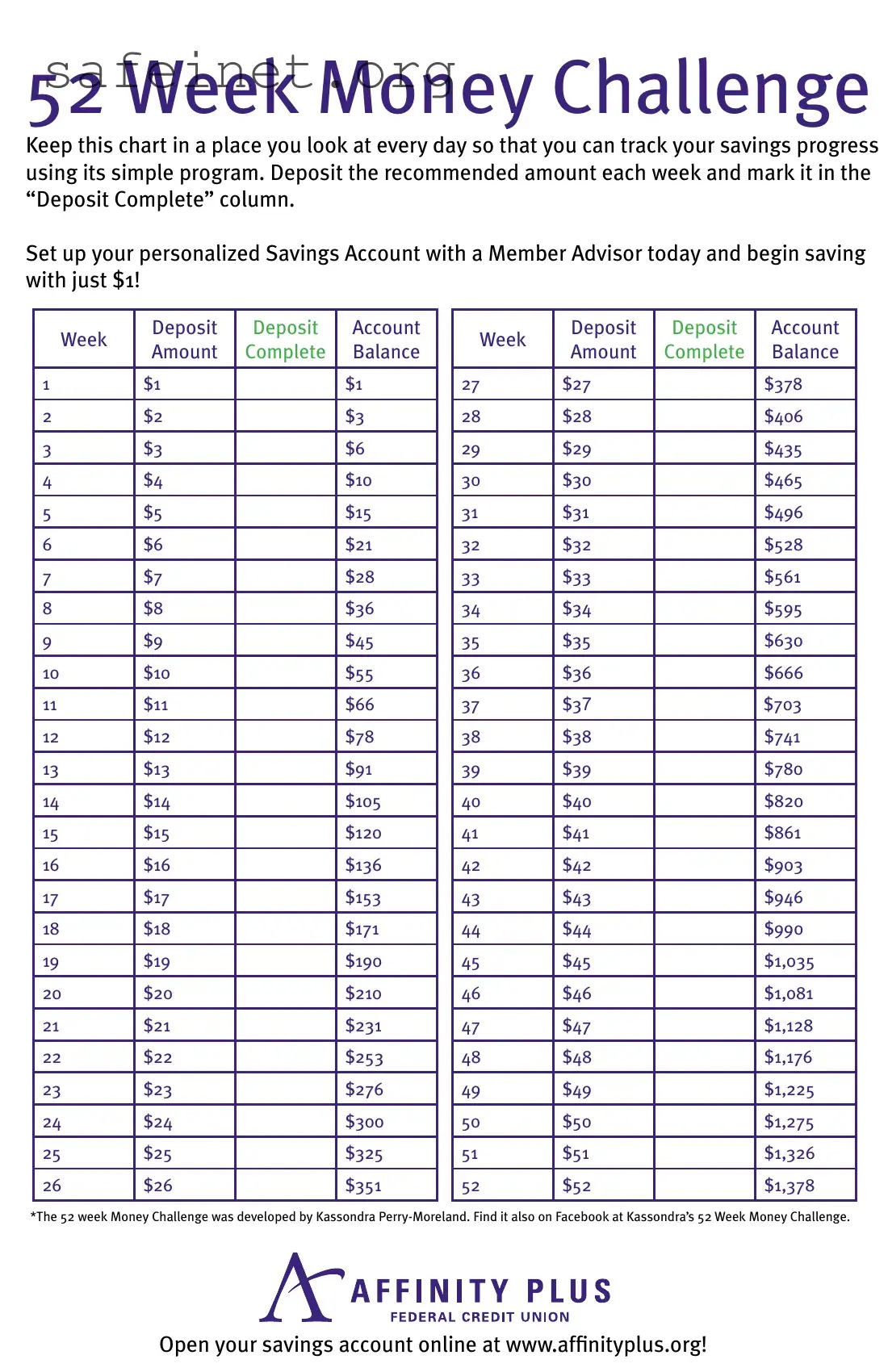

The 52 Week Money Challenge is a simple savings plan that encourages individuals to save a specific amount of money each week for one year. The idea is to progressively increase the amount saved each week, which results in accumulating a total of $1,378 by the end of the year.

How does the challenge work?

Each week, you save an amount that corresponds to the week of the year. For example, during the first week, you save $1. In the second week, you save $2, and this pattern continues through to the 52nd week, where you save $52. By the end of the year, you should have saved a total of $1,378.

Can I start the challenge at any time of the year?

Yes, you can begin the 52 Week Money Challenge at any time. While many people start in January, there are no restrictions on when to start. Just remember to follow the weekly saving structure once you begin.

What if I miss a week?

If you miss a week, you can catch up by adding the missed amount in a future week. Alternatively, you could adjust the challenge to better fit your savings capacity. The most important part is to find a method that works for you.

How do I keep track of my savings?

You can keep track of your savings in several ways. Use a dedicated savings jar, a notebook, or an app on your phone. Keeping a visual reminder can motivate you to stick to the challenge.

What should I do with the savings at the end of the year?

At the end of the year, you can choose to use the savings for a specific goal, such as a vacation, emergency fund, or a large purchase. It could also be a great time to evaluate how the challenge impacted your savings habits.

Is the 52 Week Money Challenge suitable for everyone?

The challenge is designed to be flexible and can fit into various budgets. However, it may not be suitable for everyone. If savings are tight, you might want to adjust the amounts to ensure it works for your financial situation.

Are there any pitfalls to be aware of?

Yes, one common pitfall is underestimating your expenses in certain weeks, which could lead to missing contributions. Additionally, the increasing amounts could feel overwhelming as the year progresses. It's essential to plan ahead and ensure you can keep up with the challenge.

How can I motivate myself to complete the challenge?

Setting personal goals and visualizing how you’ll use the saved money can boost your motivation. Joining a community or sharing your journey with friends and family can also provide encouragement along the way.